Real Estate Investors: How to Use AI to Find the Best Deals

The real estate market has become increasingly competitive, requiring investors to stay sharp and informed at all times.

Artificial Intelligence (AI) has emerged as a game-changing tool for finding, analyzing, and securing the best deals. With its ability to process massive amounts of data in seconds—far faster than any human—AI is no longer a luxury but a necessity for investors who want to stay ahead.

Why AI is a Must-Have for Real Estate Investors

The real estate industry generates enormous amounts of data every day, from property listings and market trends to neighborhood demographics and economic indicators.

For investors, analyzing all this information manually is time-consuming and prone to errors. AI changes the game by automating the data analysis process, delivering actionable insights in record time.

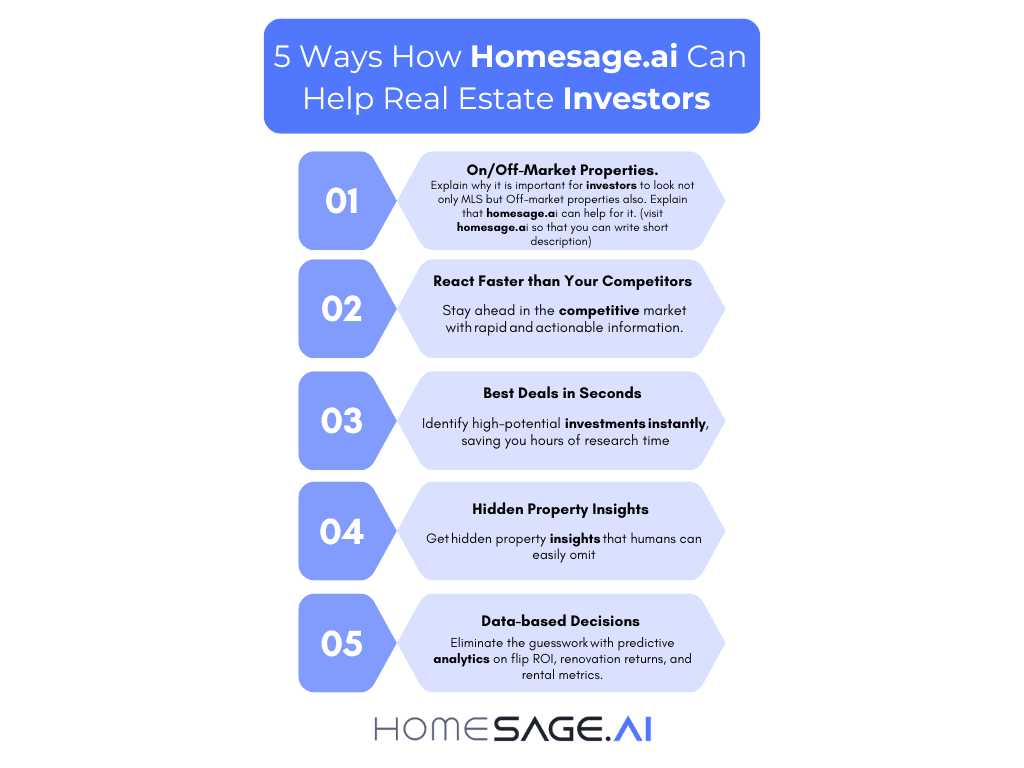

Let’s dive into five ways you can use AI to find and analyze the best deals:

1. On/Off-Market Properties

Focusing only on MLS (Multiple Listing Service) properties can limit your investment opportunities. Off-market properties—those not publicly listed—often provide good pricing, less competition, and more flexible terms. However, finding these hidden gems requires advanced tools.

Why It Matters:

- Off-market properties often have less competition and higher profit margins.

- They allow investors to negotiate directly with sellers for better terms.

How AI Helps:

- Platforms like Homesage.ai provide lists of Off-market and MLS properties in one place.

- Homesage.ai provides insights into property condition, ROI potential, renovation costs, and rental income projections.

- You could uncover hidden property insights that humans could easily miss.

2. React Faster Than Your Competitors

In real estate investing, timing is everything. The faster you can identify and act on a promising deal, the better your chances of success in a competitive market.

Why It Matters:

- The best deals often go to those who act quickly.

- Delays in decision-making can result in missed opportunities or losing out to competitors.

How AI Helps:

- AI tools provide real-time alerts on price changes, new listings, or emerging market trends.

- These tools monitor multiple data sources simultaneously, ensuring you’re always informed about new opportunities as they arise.

- By reacting faster than your competitors, you can secure deals before they even hit the broader market.

3. Find the Best Deals in Seconds

Gone are the days of spending hours—or even days—sifting through property listings to find viable investments. With AI-powered tools, identifying high-potential properties takes only seconds.

Why It Matters:

- Time saved on research can be reinvested into other aspects of your business or portfolio management.

- Faster analysis means you can evaluate more deals in less time, increasing your chances of finding profitable opportunities.

How AI Helps:

- Advanced algorithms analyze multiple factors—such as location, property features, market conditions, and projected ROI—to highlight the most lucrative investments instantly.

- By automating the research process, AI eliminates human error and ensures you focus only on high-value opportunities.

4. Uncover Hidden Property Insights

AI doesn’t just analyze surface-level data; it digs deeper to uncover insights that humans might overlook during manual analysis.

Why It Matters:

- Hidden insights can reveal undervalued properties or areas poised for growth that others might miss.

- Understanding factors like neighborhood trends or future development plans gives you a competitive edge.

How AI Helps:

- AI evaluates variables such as crime rates, school quality, transportation options, and nearby amenities to provide a comprehensive view of a property’s potential.

- Predictive analytics forecast neighborhood growth or decline based on historical trends and current data.

- These insights help you make smarter investment decisions while minimizing risks.

For example, homesage.ai offers a product named Price Flexibility Score, which provides insight into how much a seller would be open for price negotiations.

5. Make Data-Based Decisions

Real estate investing has traditionally relied on intuition and experience—but in today’s data-driven world, those alone are no longer enough to guarantee success.

Why It Matters:

- Data-backed decisions reduce uncertainty and eliminate guesswork.

- Predictive analytics provide clarity on potential ROI for flips, renovations, or rental income.

How AI Helps:

- AI evaluates key metrics like flip ROI potential, renovation returns, rental income forecasts, and long-term appreciation trends.

- By relying on hard data rather than speculation or gut feelings, investors can confidently pursue opportunities with higher chances of success.

- This approach ensures every decision is grounded in reliable forecasts tailored to your investment goals.

Conclusion

AI is transforming how real estate investors find and evaluate deals by providing faster access to actionable insights and uncovering hidden opportunities that traditional methods often miss.

Whether it’s identifying off-market properties with platforms like Homesage.ai or reacting faster than competitors with real-time alerts, leveraging AI will give you an undeniable edge in today’s competitive market.

By embracing these tools now, you’ll not only save time but also maximize your returns while minimizing risks—all essential ingredients for long-term success in real estate investing!