For savvy homebuyers and real estate investors, finding properties with equity potential is like uncovering hidden treasure. By purchasing a property with built-in equity or the potential to grow equity over time, you set yourself up for financial success.

Thanks to advancements in technology, AI has emerged as a powerful tool to uncover hidden opportunities in real estate.

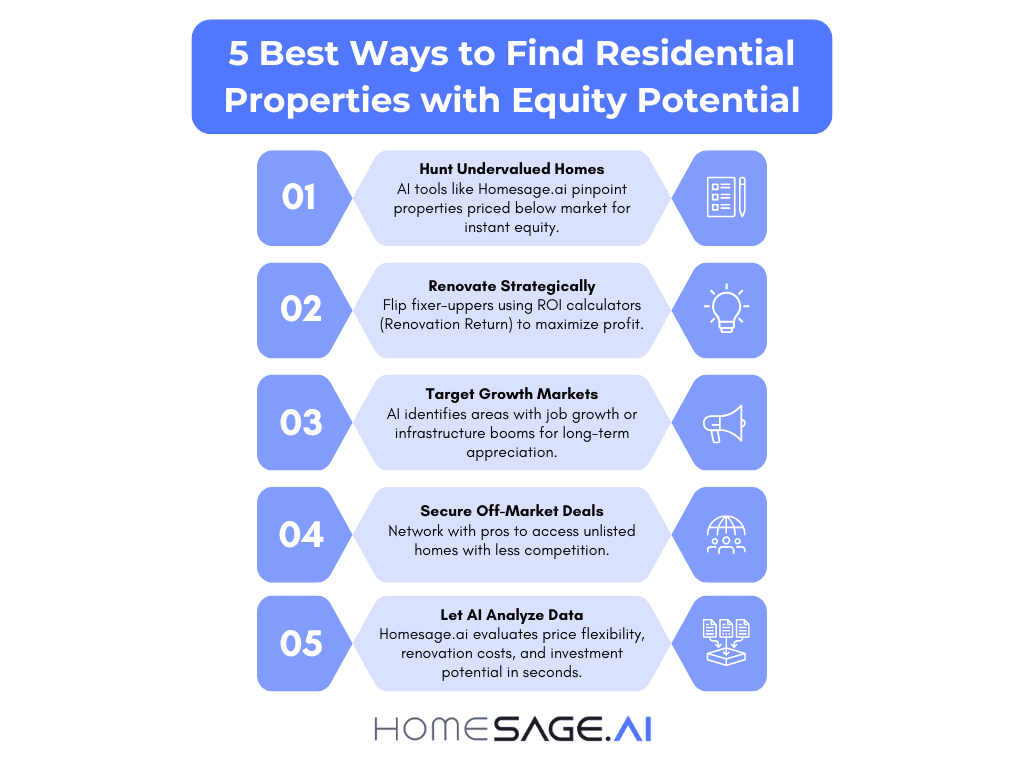

But how to use AI to find these opportunities? Let’s dive into five proven strategies, Including how AI can revolutionize your search.

1. Look for Undervalued Properties

- One of the most effective ways to find equity potential is by identifying undervalued properties. These are homes listed below their market value due to factors like motivated sellers, foreclosure, or physical condition issues.

- How to Spot Them: Use online platforms like Homesage.ai, Zillow or PropStream to compare recent sales in the area. If a property is listed significantly below comparable homes (comps), it might be undervalued.

- Why It Works

Buying below market value gives you instant equity once the property’s true value is realized. - Pro Tip: Be cautious and conduct thorough due diligence to ensure there aren’t hidden issues that could offset your gains.

Homesage.ai stands out from Zillow and PropStream by leveraging cutting-edge AI to provide actionable, investment-focused insights tailored for real estate buyers and investors.

While Zillow primarily serves as a listing platform with basic property data and PropStream offers robust tools for lead generation and market analysis, Homesage.ai goes further by offering products like AI-powered ARV calculations and Price Flexibility Score.

2. Focus on Fixer-Uppers

Properties in need of renovation often sell for less, but with strategic upgrades, they can significantly increase in value.

- What to Do: Look for homes with good bones but outdated interiors. Cosmetic fixes like painting, flooring, or kitchen upgrades often yield high returns.

- Calculate ROI: Use tools like Homesage.ai’s Renovation Return to estimate the potential return on investment for specific renovations.

- Example: A $25,000 kitchen remodel could increase a home’s value by $40,000, creating $15,000 in equity.

3. Research Growing Markets

Location is key when it comes to equity growth. Properties in areas experiencing job growth, population increases, or infrastructure development are more likely to appreciate in value.

- How to Identify Hot Markets: Research cities or neighborhoods with strong economic indicators such as new businesses, schools, or transportation hubs.

- Why It Matters: As demand rises in these areas, so do property values.

- Pro Tip: Use local government resources or real estate market reports to stay informed about upcoming developments.

4. Network with Real Estate Professionals

Sometimes the best deals never make it to public listings. Networking with agents, wholesalers, and other investors can give you access to off-market properties.

- Why Off-Market Matters: Off-market deals often come with less competition and better pricing.

- How to Start Networking: Attend local real estate meetups or join online communities like Reddit’s r/realestateinvesting.

- Bonus Tip: Build relationships with contractors and inspectors who can provide insights into a property’s condition and renovation potential.

5. Use Homesage.ai for Data-Powered Insights

For those who want a cutting-edge advantage in finding properties with equity potential, Homesage.ai is a game-changer. This AI-powered platform collects and analyzes data from both MLS and off-market listings daily to deliver actionable insights.

How Homesage.ai Helps You Find Equity Potential

Homesage.ai offers several tools tailored for savvy homebuyers and investors:

- Investment Potential: Evaluates properties based on their investment suitability. This tool helps you identify homes with strong appreciation potential or high ROI.

- Renovation Cost: Provides accurate renovation cost estimates so you can budget effectively and avoid overspending.

- Renovation Return: Calculates the potential return on investment from renovations, helping you prioritize projects that maximize equity growth.

- Price Flexibility Score: Determines how negotiable a listing price might be, giving you an edge during negotiations.

- TLC: Identifies properties needing “tender loving care,” perfect for investors looking for fixer-uppers with high upside potential.

Why Choose Homesage.ai?

Unlike traditional methods that rely on guesswork or outdated data:

- Homesage.ai uses advanced AI algorithms to uncover hidden opportunities that others might miss.

- It aggregates multiple metrics into one platform, saving you time and effort.

- The platform is ideal for both beginners and seasoned investors looking for data-driven decision-making tools.

For instance, if you’re considering a fixer-upper in an up-and-coming neighborhood, Homesage.ai can provide a full report detailing the renovation costs, expected ROI from upgrades, and even historical property value trends through its Home Value Graph API.

Final Thoughts: Combining Strategies for Maximum Equity

Finding residential properties with equity potential requires a mix of research, networking, and leveraging modern tools like Homesage.ai. Here’s how these strategies can work together:

- Start by identifying undervalued properties or fixer-uppers in growing markets.

- Use Homesage.ai’s APIs to analyze renovation costs and investment potential before making an offer.

- Network with professionals to uncover off-market opportunities that align with your goals.

By combining these approaches, you’ll not only find properties with built-in equity but also create opportunities for long-term financial growth.