AI Tools for Estimating Property ARV are transforming how real estate investors analyze deals in 2026. Imagine spending three days analyzing a property only to discover, after making an offer, that your After Repair Value estimate was off by $40,000. For real estate investors, inaccurate ARV calculations don’t just kill deals; they destroy profit margins and erode competitive advantage.

Traditional ARV estimation involves manually comparing sales data, adjusting for property differences, and hoping your calculations capture current market conditions. AI tools have changed this game completely, processing thousands of data points in seconds to deliver accuracy rates that manual methods simply can’t match.

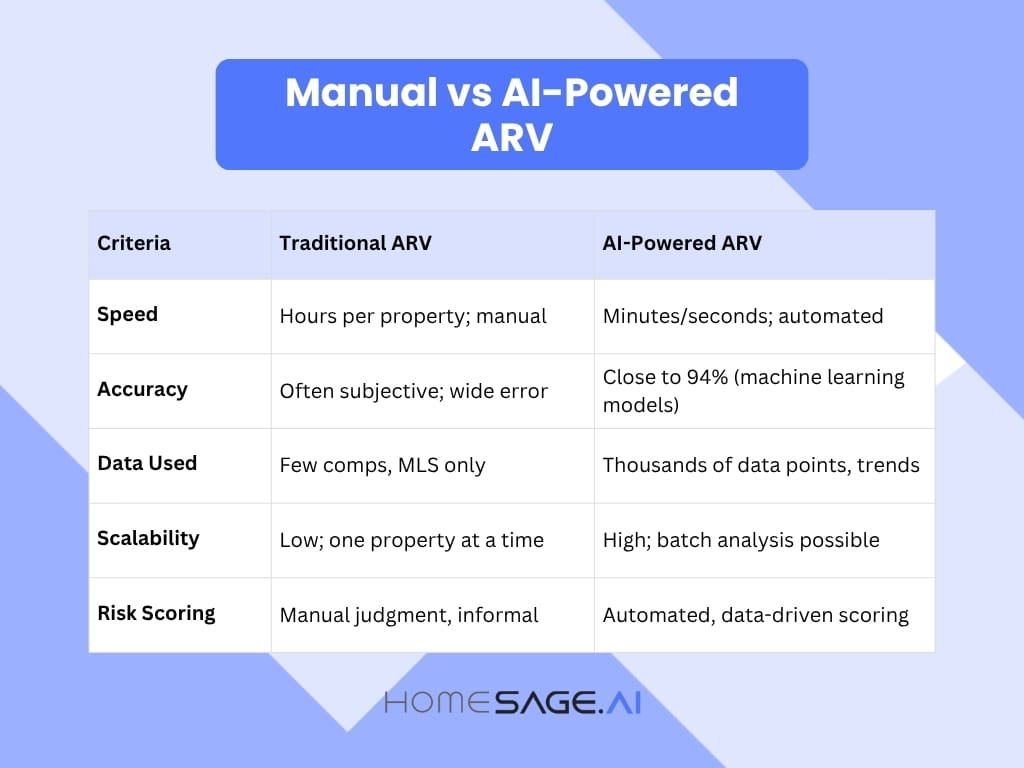

Discover the key differences between manual and AI-powered ARV (After Repair Value) analysis in real estate. Learn how AI boosts speed, accuracy, scalability, and risk scoring to make property valuation smarter and faster[/caption]

Platforms like this are leading this transformation with specialized APIs that turn property analysis from guesswork into data-driven science.

This guide explores how AI tools reshape ARV estimation for 2026, which features deliver the biggest advantages, and how you can leverage these technologies to evaluate more deals, make faster decisions, and maximize investment returns.

What is ARV and Why Accurate Estimation Matters

After Repair Value (ARV) represents the projected market value of a property after completing all planned repairs, renovations, and improvements. For fix-and-flip investors, wholesalers, and anyone purchasing distressed properties, ARV forms the foundation of every financial decision.

Your ARV estimate determines your maximum purchase price, guides renovation budgets, and forecasts potential profits. Get it wrong, and you either overpay for properties or miss opportunities by offering too little.

Most investors follow the rule that says you should pay no more than 70% of the ARV minus renovation costs.

Here’s the formula:

(ARV × 70%) – Renovation Costs = Maximum Allowable Offer

If a property has an ARV of $300,000 and needs $50,000 in repairs, your maximum offer should be $160,000. This approach builds profit margins and buffers for unexpected expenses. Without accurate ARV estimation, you’re essentially gambling with your investment capital.

This video shows how to generate Full Property Reports in seconds.

How AI Transforms ARV Estimation Speed and Accuracy

Processing Data at Impossible Speeds

Traditional ARV calculations require hours of manual work: researching comparable sales, visiting properties, adjusting differences, and compiling spreadsheets.

Homesage.ai’s AI-powered tools perform the same analysis in minutes by processing thousands of data points simultaneously. They consider historical sales, current market trends, neighborhood demographics, property characteristics, satellite imagery, and economic indicators to generate accurate valuations.

The platform provides comprehensive property details, including listing prices, square footage, features, and location specifics—all essential for precise ARV calculations. This speed advantage lets you evaluate 20 properties in the time it previously took to analyze one, creating a decisive edge in competitive markets.

Machine Learning Delivers Superior Accuracy

AI’s real power comes from machine learning algorithms that continuously improve predictions based on actual market outcomes. These systems use advanced techniques like gradient boosting, random forests, and neural networks to identify complex relationships between property features and final sale prices.

Research demonstrates that AI valuation models achieve accuracy rates of close to 94% when properly trained. Support Vector Machine (SVM) models have demonstrated R² values of 0.94, meaning they explain 94% of variance in property values.

Homesage.ai’s leverages similar machine learning capabilities to evaluate properties and categorize them based on potential returns, helping investors quickly identify the best opportunities in their markets.

Integrating Multiple Data Sources Seamlessly

AI tools excel at combining data from diverse sources that would be impossible for individuals to process manually. Modern ARV estimation systems simultaneously pull information from:

- Public records and tax assessments

- Multiple Listing Service (MLS) databases

- Historical transaction data

- Local and nationwide economic and employment indicators

- Neighborhood demographics and school ratings

- Crime statistics and safety metrics

- Infrastructure development plans

- This comprehensive approach eliminates the blind spots that plague traditional valuation methods.

Key AI-Powered Features Transforming ARV Calculation

Automated Comparable Sales Analysis

Finding and adjusting comparable sales (comps) is time-consuming in traditional ARV calculations.

Homesage.ai’s AI models automatically identify the most relevant comps by location, size, age, condition, and features, and makes precise adjustments for differences, such as extra bedrooms or updated kitchens. Considering property condition when calculating property value is especially important, and these models are the only ones of their kind on the market.

There are 6 conditions: Excellent, Good, Average, Outdated, Poor, or Very Poor—ensuring accurate, “apples-to-apples” comparisons for ARV calculations.

Renovation Cost and ROI Estimation

Knowing ARV is only half the equation—you also need accurate renovation cost estimates to determine if deals make financial sense. AI models analyze property images, identify needed repairs, and estimate costs based on local labor rates and material prices.

These systems assess property condition from photos, detecting issues like roof damage, outdated fixtures, water damage, or structural concerns. This capability helps investors budget accurately and avoid costly surprises that sink fix-and-flip projects.

Homesage.ai‘s estimates renovation expenses for budgeting and financial planning, while they calculate potential ROI from those renovations—giving you both sides of the profit equation instantly.

Risk Assessment and Deal Scoring

Not all investment opportunities are created equal, and AI helps investors prioritize deals based on risk-adjusted returns. Advanced platforms assign scores to properties based on market volatility, neighborhood stability, renovation complexity, and exit strategy viability.

Homesage.ai‘s Price Flexibility Score determines how negotiable property listing prices are, giving investors insight into potential price reductions, critical information when trying to meet 70% rule requirements.

These risk assessments help you avoid properties that look attractive on paper but carry hidden dangers, from declining neighborhoods to properties with title issues or environmental concerns.

Practical Applications Across Investment Strategies

Fix-and-Flip Analysis

For fix-and-flip investors, AI tools streamline the entire analysis process from initial evaluation to exit strategy. You can quickly determine whether properties meet the 70% rule, estimate renovation timelines, and project final sale prices with confidence.

Homesage.ai‘s models estimate anticipated returns from buying, renovating, and selling properties, detailing renovation costs, profits, and ROI in a single report. These tools eliminate guesswork and help you move quickly in competitive markets where delays cost deals.

Instead of spending days analyzing single properties, you can evaluate dozens and focus energy on the best opportunities.

Rental Property Investment

For buy-and-hold investors, ARV estimation helps determine whether purchasing and renovating properties will generate positive cash flow and appreciation. AI tools can compare the costs of buying distressed properties and renovating them versus purchasing turnkey rentals. This can be extremely beneficial for investors who want to start their investment journey with extra equity in each property.

Homesage.ai’s platform evaluates all use case scenarios, including Airbnb, and provides estimated rental values and financial metrics like cash flow, cap rates, and annual projections for both investment strategies.

These tools help you understand whether renovation costs will be recovered through higher rents or if you’re better off seeking properties in better condition.

Choosing the Right AI ARV Tools

Essential Platform Features

Not all AI valuation tools offer the same capabilities, and choosing the right platform depends on your specific investment focus. Essential features include:

- Real-time data updates ensuring valuations reflect current market conditions

- Local market coverage with comprehensive data in your target investment areas

- Integration capabilities that work with your existing tools and workflows

- Transparent methodology so you understand how valuations are calculated

- Accuracy tracking showing how past predictions matched actual outcomes

The best platforms you can share with lenders, partners, and contractors to justify investment decisions.

Hybrid Human-AI Models Deliver Best Results

Research shows that combining AI analysis with human expertise produces the most accurate valuations. Properties evaluated using hybrid models show 15% higher accuracy compared to AI-only systems.

The most effective approach uses AI for data processing, comp selection, and initial valuations, while human experts provide context on unique property features, neighborhood dynamics, and market nuances that algorithms might miss. This combination delivers both speed and precision.

Homesage.ai takes a unique API approach, allowing real estate professionals to integrate AI-powered property intelligence into their websites, existing systems and workflows. This flexibility enables investors to build customized analysis processes that combine AI efficiency with human judgment. It also allows realtors to offer these services to investors and attract them as potential clients.

Key Takeaways

- Speed creates competitive advantage: AI-powered ARV estimation reduces analysis time from days to minutes, allowing investors to evaluate more deals and respond faster in competitive markets where timing determines success.

- Accuracy rates can reach 94%: Machine learning models deliver accuracy rates of close to 94% with median absolute percentage errors as low as 2.8%, far exceeding traditional manual calculation methods.

- Comprehensive data integration eliminates blind spots: Modern AI platforms combine MLS data, public records, market trends, neighborhood demographics, and economic indicators to provide complete investment pictures that manual research can’t match.

- Specialized APIs enable custom workflows: Platforms like Homesage.ai offer targeted APIs for property condition assessment, renovation cost estimation, investment potential evaluation, and rental income projections, allowing investors to build customized analysis workflows.

- Hybrid models outperform AI-only systems: Combining AI’s data processing power with human expertise produces 15% higher accuracy than AI-only systems, making this the optimal approach for serious investors.

- The 70% rule becomes more precise: AI tools make applying the traditional 70% rule more accurate by providing reliable ARV estimates and renovation cost projections, helping investors determine maximum allowable offers with confidence.

Conclusion

The real estate investing landscape has fundamentally transformed, and AI-powered ARV estimation tools are no longer optional for investors competing effectively in 2026. These technologies deliver speed, accuracy, and comprehensive analysis that manual methods simply cannot replicate, turning what used to be an art form into data-driven science.

The investors who thrive in the coming years will embrace these tools while understanding their limitations. AI excels at processing data and identifying patterns, but human judgment remains essential for context, relationship-building, and understanding unique local market dynamics.

Whether you’re flipping houses, wholesaling deals, or building rental portfolios, integrating AI-powered property analysis into your workflow will help you make smarter decisions, avoid costly mistakes, and identify opportunities others miss.

Platforms make this technology accessible through specialized APIs designed for real estate professionals, investors, and developers.

The question isn’t whether to adopt AI for ARV estimation—it’s how quickly you can integrate these tools into your investment process.

Explore Homesage.ai‘s suite of property intelligence APIs and see how AI-powered analysis can transform your investment outcomes.

Frequently Asked Questions

Q: How accurate are AI tools for estimating property ARV compared to traditional appraisals?

A: AI-powered ARV tools achieve accuracy rates of 94% when using advanced machine learning models like Neural Networks, Support Vector Machines and Random Forests.

The following is a comparison table between Traditional ARV and AI-powered ARV:

Criteria | Traditional ARV | AI-Powered ARV |

Speed | Hours per property; manual | Minutes/seconds; automated |

Accuracy | Often subjective; wide error | Close to 94% (machine learning models) |

Data Used | Few comps, MLS only | Thousands of data points, trends |

Scalability | Low; one property at a time | High; batch analysis possible |

Risk Scoring | Manual judgment, informal | Automated, data-driven scoring |

However, the most accurate results come from hybrid approaches that combine AI analysis with human appraiser expertise, which shows 15% higher accuracy than AI-only systems. For official financing purposes, lenders still require traditional appraisals, but AI tools excel at initial investment screening and deal analysis.