Introduction

Increasing deal volume for hard money lenders is critical in the fast-paced real estate market. Hard and private money lenders and their clients are constantly on the lookout for investment opportunities. To succeed in this competitive landscape, they need access to the right tools and resources that can help them identify profitable properties and make informed lending decisions.

Homesage.ai has recognized this need and developed a suite of AI-powered products designed to empower hard money lenders to increase their deal volume and boost their business growth.

In this article, we will delve into the three main products offered by Homesage.ai: Investment Property Lists, Full Property Reports, and APIs, and explore how they can assist hard money lenders in increasing their deal volume.

1. Investment Property Lists

Homesage.ai's Investment Property Lists empower hard money lenders to help their existing and potential clients find properties with high investment potential. These lists are generated daily by Homesage.ai's AI models, resulting in a significant decrease in manual search work for lenders and their clients. This tool is essential for hard money lenders aiming to increase deal volume by quickly identifying profitable opportunities.

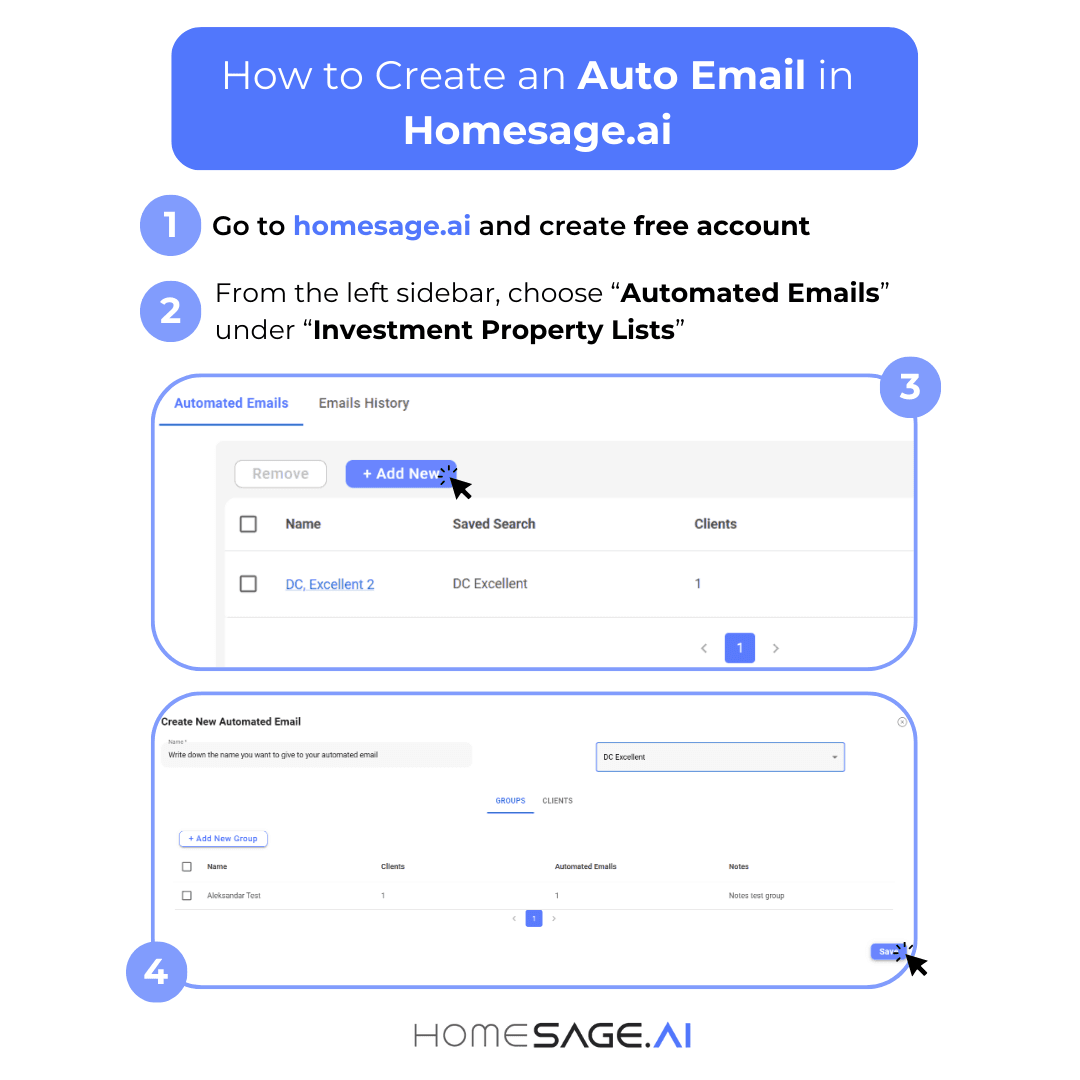

Lenders can also set up daily update emails for their clients with two clicks. In this way, their clients will be regularly updated and first to know about all new properties with investment potential in their target area, further assisting in increasing deal volume for hard money lenders.

Key Features within Investment Property Lists

- Investment Potential: Homesage.ai's AI models analyze every property coming to the market daily in the United States, identifying those with the highest investment potential. Lenders and their clients can quickly access properties that align with their investment goals, directly contributing to increased deal volume.

- Renovation Cost Estimates: Hard money lenders need to know the cost of property renovations accurately. This subgroup provides a detailed breakdown of renovation costs, considering variables like property condition, size, materials tier, and location.

- After Repair Value (ARV) Estimate: Shows the value of a given property after renovations are completed, crucial for lenders looking to increase deal volume through successful investments.

- Renovation Returns: Provides estimates on returns from renovations, including cost projections, ROI calculations, and recommended renovation budget limits, aiding in increasing deal volume.

- Flip Returns: Offers valuable insights into potential resale returns for property flipping, helping lenders predict profitability and make informed decisions.

- Long-Term Rental Metrics: Provides estimates for monthly revenues, cap rates, IRR, and other financial metrics for long-term rental properties, contributing to increased deal volume.

- Short-Term Rental Metrics (Airbnb): Calculates expected metrics for short-term rentals, including income and return rates, enabling lenders to understand potential profitability.

- Investment Potential per Area: Helps lenders select areas with the best opportunities, whether a neighborhood, city, county, or state, thus increasing deal volume.

- Price Flexibility Score: Indicates the potential for price negotiation, offering invaluable insight when making offers and assisting in increasing deal volume.

- TLC (Tender Loving Care): Uses AI to identify properties in need of renovation or repair and calculates key investment metrics for them, contributing to increased deal volume.

2. Full Property Reports

The Full Property Report offered by Homesage.ai is a comprehensive resource that provides hard money lenders with a deep understanding of any property in the USA. This detailed report equips lenders with the knowledge they need to make informed lending decisions, directly impacting their ability to increase deal volume.

Additional Metrics in the Full Property Report

- Listing Price/ARV: Shows the listing price as a percentage of the After Repair Value. This metric is the simplest way to quickly assess investment potential, aiding lenders in increasing deal volume.

- Property Info and History: Offers comprehensive details about the property's background and characteristics, helping lenders make informed decisions and increase deal volume.

3. APIs

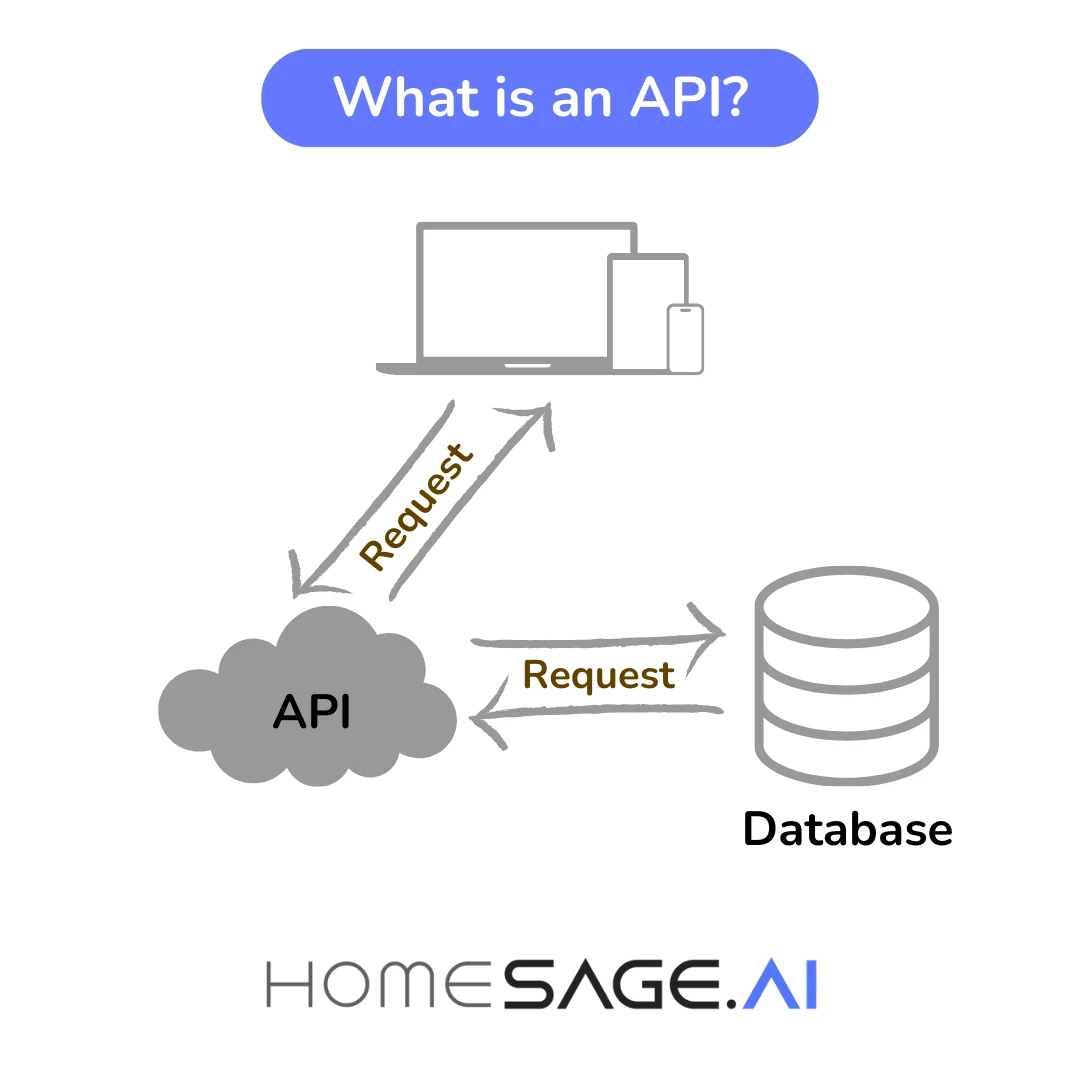

What is an API?

Homesage.ai's APIs are a powerful tool for hard money lenders looking to integrate revolutionary elements on their websites. These APIs allow lenders to incorporate any of the elements above directly on their websites and platforms, resulting in real-time information access, which can significantly increase deal volume.

Main Characteristics of Elements APIs

- Onboarding Support: Integrating APIs into existing systems may require work by IT specialists. Homesage.ai offers onboarding support to assist lenders in effectively integrating and utilizing the APIs to enhance their lending operations and increase deal volume.

- Secured Authentication: Security is paramount when dealing with sensitive real estate data. Homesage.ai ensures secure authentication for its APIs, giving lenders peace of mind when accessing valuable information, thereby supporting their efforts to increase deal volume.

Plans and Pricing

Homesage.ai offers clear pricing for each of its plans, designed to fit any business size. This flexibility enables hard money lenders to choose options that best support their goal to increase deal volume.

Conclusion

In the competitive world of hard and private money lending, having access to the right tools and information can make all the difference. Homesage.ai's innovative products offer hard money lenders a unique advantage in helping their clients identify profitable properties, assess their potential, and streamline their lending processes.

By leveraging these AI-powered solutions, hard money lenders can increase deal volume, make informed lending decisions, and ultimately achieve greater success in the real estate market. Stay ahead of the competition and increase your deal volume with Homesage.ai's cutting-edge proptech solutions.