Is AI the Key to Predicting Real Estate Bubbles?

Real estate bubbles, times when property prices rise too fast and then suddenly crash, can be devastating for buyers, investors, and the economy.

Can technology, especially AI, help us foresee these dangerous market spikes before they happen?

In this post, we’ll explore how AI assists in predicting these bubbles, what it means for property buyers and investors, and how tools like those from Homesage.ai can offer an edge in navigating the real estate market safely.

What Causes Real Estate Bubbles?

To understand how AI helps, let’s first look at why bubbles happen. Typically, bubbles form when demand for homes surges, either because more people want to buy properties or because of easy access to loans. This demand pushes prices up. Then, when interest rates rise or the economy slows, people can’t keep up with mortgage payments or no longer want to buy, causing prices to plummet.

AI technology can catch early warning signs in the market, helping investors and buyers avoid risky areas. Homesage.ai’s tools analyze multiple factors, such as property values and local demand, allowing users to make well-informed choices even in uncertain times.

How AI Predicts Market Patterns

AI doesn’t just look at one or two things; it gathers data from hundreds of sources, including housing prices, interest rates, economic indicators, and buyer trends. It then processes this information to identify patterns that might indicate an upcoming bubble. By analyzing such data, AI can spot red flags before they’re visible to human eyes.

For example, a spike in property prices paired with a drop in rental demand might suggest that the market is overheated.

Homesage.ai’s Investment Potential API evaluates properties based on factors like market trends and potential returns, helping users assess a property’s suitability as an investment. This allows buyers and investors to focus on properties with stronger long-term potential rather than being swayed by market hype.

To better understand AI’s role, consider these key patterns it detects:

- Sudden spikes in property prices without corresponding economic growth.

- Declines in rental occupancy rates amid rising sales.

- Shifts in buyer demographics that don’t align with local job markets.

- Historical comparisons showing deviations from normal appreciation rates.

The Importance of Big Data in Real Estate Predictions

Data is the fuel that powers AI. Imagine how much information an AI system can analyze when looking at years’ worth of property sales, regional economic health, and even recent buyer behaviors. This vast amount of data allows AI to create models of what a stable market should look like and compare current data against these models.

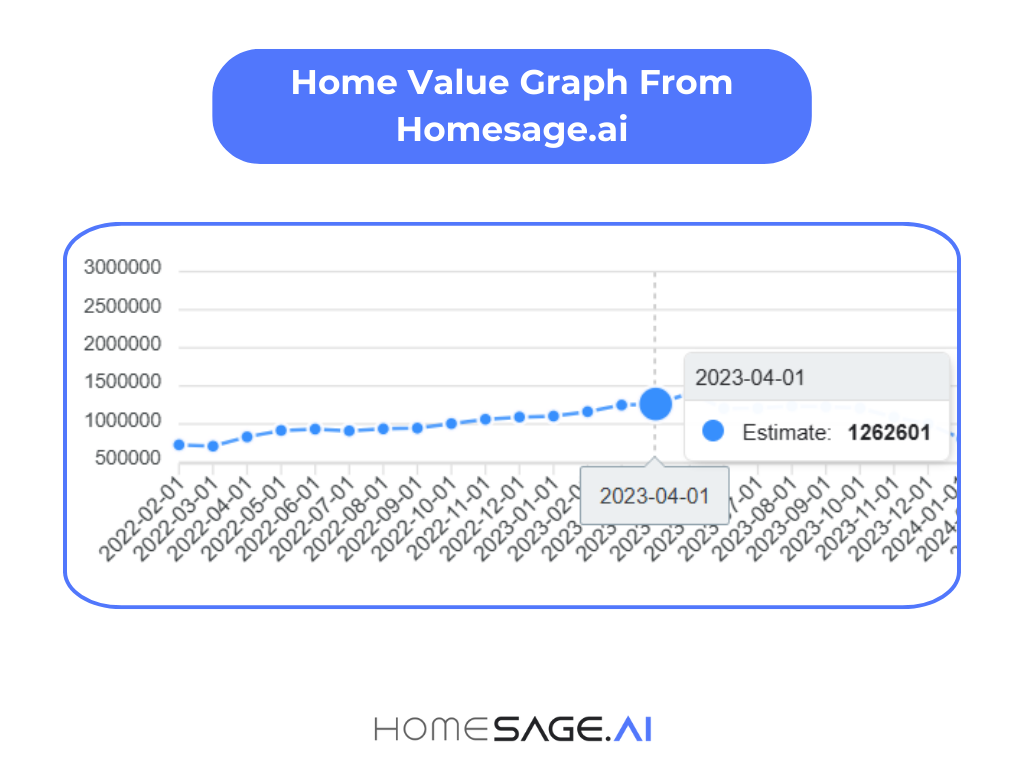

Through the Home Value Graph API, Homesage.ai offers historical value data for properties, making it easier to see trends in price changes over time. If a neighborhood is showing rapid appreciation that doesn’t align with long-term trends, that’s a signal that prices might be rising faster than the market can sustain.

For more on how big data transforms predictions, explore this article on real estate analytics. Additionally, check our blog on market trends for related insights.

Using AI to Understand Property Conditions

AI can also predict the value of a property based on its physical state and potential for renovation. Homesage.ai’s Renovation Cost API and TLC API provide valuable insights into renovation costs and potential ROI on fixer-uppers.

For example, suppose a neighborhood with several “outdated” properties suddenly experiences a surge in high-priced listings. In that case, it could be an early sign that prices are rising artificially due to speculation rather than genuine demand.

These insights allow investors to make better decisions, as AI can help them see past flashy listings and understand a property’s true potential and the costs involved.

Here are some benefits of using AI for property condition analysis:

- Accurate estimation of renovation expenses.

- Identification of high-ROI opportunities in undervalued homes.

- Comparison of current conditions against market standards.

- Prediction of future value post-renovation.

Learn more from this guide on property renovations or our page on investment tools.

Predicting Price Flexibility with AI

Another way to spot bubbles is by examining price flexibility. When properties are sold for far less than the asking price, it could indicate that sellers are eager to exit the market, an early sign of trouble. The Price Flexibility Score (PFS) API from Homesage.ai helps users understand the likelihood of negotiating a lower purchase price, providing insights into whether the market is cooling off.

A high price flexibility score means buyers might be able to negotiate a better deal, indicating that the demand might not be as strong as it seems. In contrast, a low score could mean that buyers are competing fiercely, which can sometimes be a sign of an overheated market.

For deeper insights, read this analysis on market flexibility and our blog post on negotiation strategies.

AI-Powered Property Reports for Investors

When considering a property for investment, having a full report on its current condition, potential for return, and history is crucial. Homesage.ai’s Full Property Reports gather data from all the relevant APIs, including renovation costs, price flexibility, and investment potential, to give a complete view of the property. With this level of detail, buyers and investors can better judge whether a property is genuinely worth its asking price.

Conclusion

While AI can’t guarantee that every bubble will be predicted, it certainly gives buyers and investors a valuable advantage. By examining market trends, price patterns, and property conditions, AI can provide early warnings and support better decision-making.

So, is AI the future of real estate investment? The answer seems to be yes.

Frequently Asked Questions:

What is a real estate bubble?

A real estate bubble happens when high demand and easy loans inflate home prices, leading to a crash from rising rates or economic slowdowns. Homesage.ai’s tools help detect these cycles early.

How does AI predict real estate bubbles?

AI processes data like prices and trends to spot overheating signs, such as spikes without economic growth. Check this AI models guide or Homesage.ai’s Investment Potential API.

What role does big data play in predictions?

Big data analyzes sales history, economic health, and behaviors to model stable markets and flag risks. Explore Homesage.ai’s Home Value Graph API for trend insights.

Can AI evaluate property conditions?

Yes, AI forecasts renovation costs and ROI for properties, avoiding speculation traps. Use Homesage.ai’s Renovation Cost API to assess fixer-uppers accurately.

What is price flexibility and why does it matter?

It measures negotiation potential, indicating market cooling if high or bubbles if low. Homesage.ai’s PFS API aids in spotting these signals.