Real estate investors constantly face a crucial decision: should they focus on off-market properties or stick with traditional MLS listings? This choice can significantly impact their investment success, profit margins, and overall portfolio growth. Understanding the fundamental differences between these two property acquisition methods is essential for making informed investment decisions.

Both off-market properties and MLS listings offer unique advantages and challenges for investors. While MLS listings provide transparency and accessibility, off-market properties often present opportunities for better deals with less competition. The key lies in understanding when and how to leverage each approach effectively.

What Are MLS Listings?

The Multiple Listing Service (MLS) is a comprehensive database used by real estate professionals to share information about properties for sale. When a property is listed on the MLS, it becomes visible to all participating real estate agents, brokers, and eventually, the general public through various real estate websites.

MLS listings represent the traditional, transparent marketplace for real estate transactions. These properties are actively marketed, professionally photographed, and available for viewing by any interested buyer.

The MLS system ensures standardized information sharing and creates a level playing field where all market participants have access to the same property data.

Properties on the MLS typically go through a formal listing process, complete with property descriptions, pricing history, and detailed specifications. This transparency makes MLS listings ideal for first-time investors or those who prefer a straightforward, well-documented investment process.

You can learn more about what MLSs are here.

What Are Off-market Properties?

Off-market properties, also known as “pocket listings” or “whisper listings,” are properties available for purchase that aren’t listed on the MLS or advertised publicly. These properties are sold through private networks, direct marketing, or word-of-mouth referrals before they hit the open market.

Off-market deals often arise from various circumstances, including distressed sales, estate settlements, divorce proceedings, or situations where sellers prefer privacy. Property owners might choose to sell off-market to avoid the traditional listing process, reduce marketing costs, or maintain confidentiality.

These properties represent a hidden marketplace that many investors consider the holy grail of real estate investing.

Since they’re not widely advertised, off-market properties typically face less competition, potentially allowing investors to negotiate better terms and prices.

Importance of MLS Listings for Real Estate Investors

MLS listings serve as the foundation of the traditional real estate market, offering several critical advantages for investors:

- Market Transparency and Data Access

MLS listings provide comprehensive property information, including detailed descriptions, high-quality photos, pricing history, and comparable sales data. This transparency allows investors to make informed decisions based on complete market information. - Professional Support System

Working with MLS listings means accessing a network of professional real estate agents, brokers, and support services. These professionals can provide market insights, handle negotiations, and guide investors through complex transactions. - Financing and Due Diligence

Properties listed on the MLS typically have clear titles, professional inspections, and established market values, making financing and due diligence processes more straightforward. Lenders are generally more comfortable financing MLS-listed properties due to their transparency and market validation.

Importance of Off-market Properties for Real Estate Investors

Off-market properties hold special significance for serious real estate investors seeking competitive advantages:

- Reduced Competition

Since off-market properties aren’t publicly advertised, they attract fewer potential buyers. This reduced competition often allows investors to negotiate better prices and terms without engaging in bidding wars. - Access to Distressed Opportunities

Many off-market properties come from motivated sellers facing time constraints, financial difficulties, or other pressing circumstances. These situations often create opportunities for below-market acquisitions. - Portfolio Scalability

Successful investors who master off-market acquisition strategies can scale their portfolios more rapidly by accessing a continuous pipeline of deals not available to the general public.

Pros and Cons of MLS Listings

Pros of MLS Listings:

- Transparency and reliability – Complete property information and professional oversight

- Wide selection – Access to thousands of properties in any given market

- Professional support – Real estate agents provide guidance throughout the process

- Financing accessibility – Lenders readily finance MLS-listed properties

- Market validation – Listed prices reflect current market conditions

- Legal protection – Standardized contracts and disclosure requirements

Cons of MLS Listings:

- High competition – Multiple buyers often compete for desirable properties

- Market-rate pricing – Properties typically priced at or near market value

- Limited negotiation power – Sellers have multiple options and less motivation to negotiate

- Timing constraints – Popular properties may sell quickly with little time for thorough analysis

- Commission costs – Buyer agents typically receive 2.5-3% commission, potentially affecting negotiation dynamics

Pros and Cons of Off-market Properties

Pros of Off-market Properties:

- Below-market pricing opportunities – Potential for significant discounts

- Reduced competition – Fewer buyers competing for the same property

- Direct seller relationships – Opportunity to build rapport and understand seller motivations

- Flexible terms – More room for creative financing and deal structuring

- First access – Opportunity to secure properties before they hit the open market

- Higher profit potential – Better margins due to lower acquisition costs

Cons of Off-market Properties:

- Limited inventory – Fewer available properties compared to MLS

- Due diligence challenges – Less available information requiring more independent research

- Higher risk potential – Properties may have hidden issues not immediately apparent

- Financing difficulties – Lenders may be more cautious with off-market properties

- Time-intensive process – Requires significant effort to build networks and find deals

- Professional isolation – Less access to real estate professionals and support services

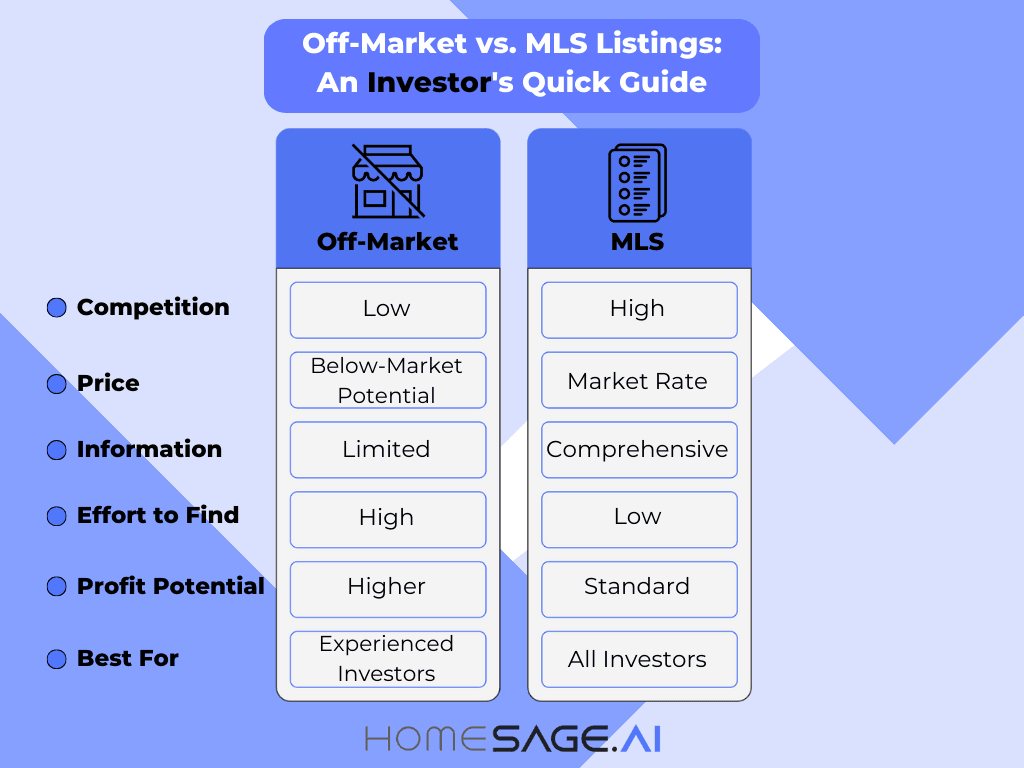

Table 1: Off-market Properties vs. MLS Listings Comparison

Feature | Off-market Properties | MLS Listings |

Competition Level | Low/medium | Higher |

Pricing | Below-market potential | Market-rate |

Information Access | Limited | Comprehensive |

Inventory Size | Limited | Extensive |

Negotiation Power | Higher | Moderate |

Time Investment | Higher | Moderate |

Risk Level | Higher | Lower |

Profit Potential | Higher | Standard |

Where to Find Off-market Properties and MLS Listings

Homesage.ai

Homesage.ai stands out as the premier choice for real estate investors because it’s the only platform that provides both off-market properties and MLS listings in one comprehensive solution.

This unique dual-access capability eliminates the need for multiple subscriptions and platforms, streamlining the investment process significantly.

The platform combines advanced AI-powered property analysis with extensive databases covering both traditional and off-market opportunities.

Homesage.ai‘s comprehensive approach makes it an invaluable resource for serious investors seeking maximum market coverage and efficiency.

MLS Listing Platforms

Zillow

Zillow remains one of the most popular consumer-facing platforms for MLS listings. It offers extensive property data, market analytics, and user-friendly search functionality.

The platform provides estimated property values, rental estimates, and neighborhood information, making it valuable for preliminary investment analysis.

Redfin

Redfin provides direct MLS access with real-time updates and comprehensive property information.

This platform offers advanced search filters, market insights, and direct agent connections. Redfin’s data accuracy and professional integration make it particularly valuable for serious investors.

Off-market Property Platforms

DealMachine

DealMachine specializes in helping investors find distressed and off-market properties through driving for dollars, direct mail campaigns, and lead generation tools.

The platform combines property data with marketing automation to help investors identify and contact potential sellers.

PropStream

PropStream offers comprehensive property data and analytics focused on identifying investment opportunities.

PropStream provides detailed property histories, owner contact information, and market analysis tools specifically designed for real estate investors seeking off-market deals.

Table 2: Platform Features and Pricing Overview

Platform | Property Types | Key Features | Best For |

Homesage.ai | Both MLS & Off-market | AI analysis, Dual access, Comprehensive data | Investors / Proptech / Fintech |

Zillow | MLS Listings | User-friendly, Market estimates, Wide coverage | Beginner investors |

Redfin | MLS Listings | Real-time MLS, Professional tools, Accurate data | Active investors |

DealMachine | Off-market | Lead generation, Direct mail, Mobile app | House flippers |

PropStream | Off-market | Owner data, Market analysis, Investment tools | Wholesalers |

Investment Strategy Considerations

Successful real estate investors often employ a hybrid approach, utilizing both MLS listings and off-market properties depending on market conditions, investment goals, and available opportunities. The key is understanding when each approach offers the greatest advantage.

In competitive markets with low inventory, off-market properties become increasingly valuable as they provide access to deals unavailable through traditional channels. Conversely, in buyer’s markets with abundant inventory, MLS listings may offer sufficient opportunities without the additional effort required for off-market sourcing.

Market timing also plays a crucial role in strategy selection. During economic downturns or periods of distress, off-market opportunities typically increase as more property owners seek quick, private sales. During stable or appreciating markets, MLS listings may provide more reliable and predictable investment opportunities.

Key Takeaways

- Off-market properties offer higher profit potential but require more effort and carry additional risks

- MLS listings provide transparency and professional support but face higher competition and market-rate pricing

- Successful investors often combine both approaches for maximum market coverage

- Platform selection significantly impacts deal flow and investment success

- Homesage.ai provides unique dual-access to both property types, streamlining the investment process

- Zillow, Redfin, PropStream and DealMachine are other sources for MLS and off-market deals

- Due diligence requirements vary significantly between off-market and MLS properties

- Market conditions should influence strategy selection between off-market and MLS focus

Conclusion

The choice between off-market properties and MLS listings isn’t necessarily an either-or decision. The most successful real estate investors understand the unique advantages of each approach and leverage both strategies depending on market conditions, investment goals, and available opportunities.

While off-market properties offer the potential for below-market acquisitions and higher profits, they require significant time investment, strong networks, and enhanced due diligence capabilities. MLS listings provide transparency, professional support, and extensive inventory, but typically come with higher competition and market-rate pricing.

The key to success lies in building capabilities in both areas while utilizing comprehensive platforms like Homesage.ai that provide access to both property types.

This dual approach ensures maximum market coverage and investment opportunities while maintaining the flexibility to adapt strategies based on changing market conditions.

People Alo Ask

Q: Are off-market properties always cheaper than MLS listings?

A: Not necessarily. While off-market properties often present opportunities for below-market purchases due to reduced competition and motivated sellers, pricing depends on various factors, including property condition, seller motivation, and local market dynamics.

Some off-market properties may be priced at or above market value, particularly if sellers believe they’re offering exclusive access.

Q: How do I verify the legitimacy of off-market property deals?

A: Verification requires thorough due diligence, including title searches, property inspections, comparable market analysis, and verification of seller ownership.

Work with qualified real estate attorneys, conduct independent property valuations, and verify all claims through official records. Never skip professional inspections or legal reviews, regardless of time pressure from sellers.

Q: Can I get financing for off-market properties as easily as MLS listings?

A: Financing off-market properties can be more challenging as lenders prefer properties with established market values and transparent transaction histories.

However, financing is definitely possible with proper documentation, professional appraisals, and working with lenders experienced in investment properties. Preparation and documentation are key to successful financing for off-market acquisitions.