Investment property analysis tools have become indispensable for real estate investors seeking to make informed decisions in an increasingly competitive market.

These tools provide critical insights into property performance, market trends, and financial projections, enabling investors to maximize returns and minimize risks.

With the advent of artificial intelligence (AI), these tools have become even more powerful, offering predictive analytics, automation, and enhanced accuracy that traditional methods cannot match.

This blog explores why these tools are crucial, the role of AI in their functionality, and reviews three of the best AI-powered investment property analysis tools available today.

Why Investment Property Analysis Tools Are Important

Investment property analysis tools are essential for several reasons:

- Data-Driven Decision Making: These tools aggregate and analyze vast amounts of data, such as market trends, rental income potential, expenses, and property appreciation rates. This helps investors make decisions based on hard evidence rather than speculation.

- Risk Mitigation: By providing detailed financial projections and identifying potential risks, these tools enable investors to anticipate challenges and plan accordingly.

- Efficiency: Manual property analysis can be time-consuming and prone to errors. Automated tools streamline the process, saving time and ensuring accuracy.

- Scalability: For investors managing multiple properties or portfolios, these tools help track performance metrics across all investments simultaneously.

Why AI is Transforming Investment Property Analysis

AI has revolutionized investment property analysis by introducing advanced capabilities that traditional methods lack:

- Predictive Analytics: AI algorithms can forecast future property values, rental demand, and market trends with high accuracy based on historical data and current conditions.

- Automated Insights: AI-powered tools can process complex datasets in seconds to deliver actionable insights without requiring manual intervention.

- Personalization: These tools adapt to individual investor preferences and goals, offering tailored recommendations for optimal investment strategies.

- Improved Accuracy: Machine learning models reduce human error by continuously refining their understanding of market dynamics.

1. Homesage.ai

Homesage.ai stands out as a market-leading tool for investment property analysis due to its innovative use of AI technology combined with user-friendly features tailored for real estate investors.

Key Features

- Property Valuation Engine: Homesage.ai uses proprietary AI algorithms to calculate accurate property values based on local market conditions, comparable sales data, and other relevant factors.

- Short/Long-Term Rental Estimation: The tool provides reliable estimates of rental income potential by analyzing neighborhood trends, demand patterns, and historical rental data, including Airbnb.

- Market Insights Dashboard: Investors gain access to a comprehensive dashboard that highlights key metrics such as cap rates, ROI projections, and expense breakdowns.

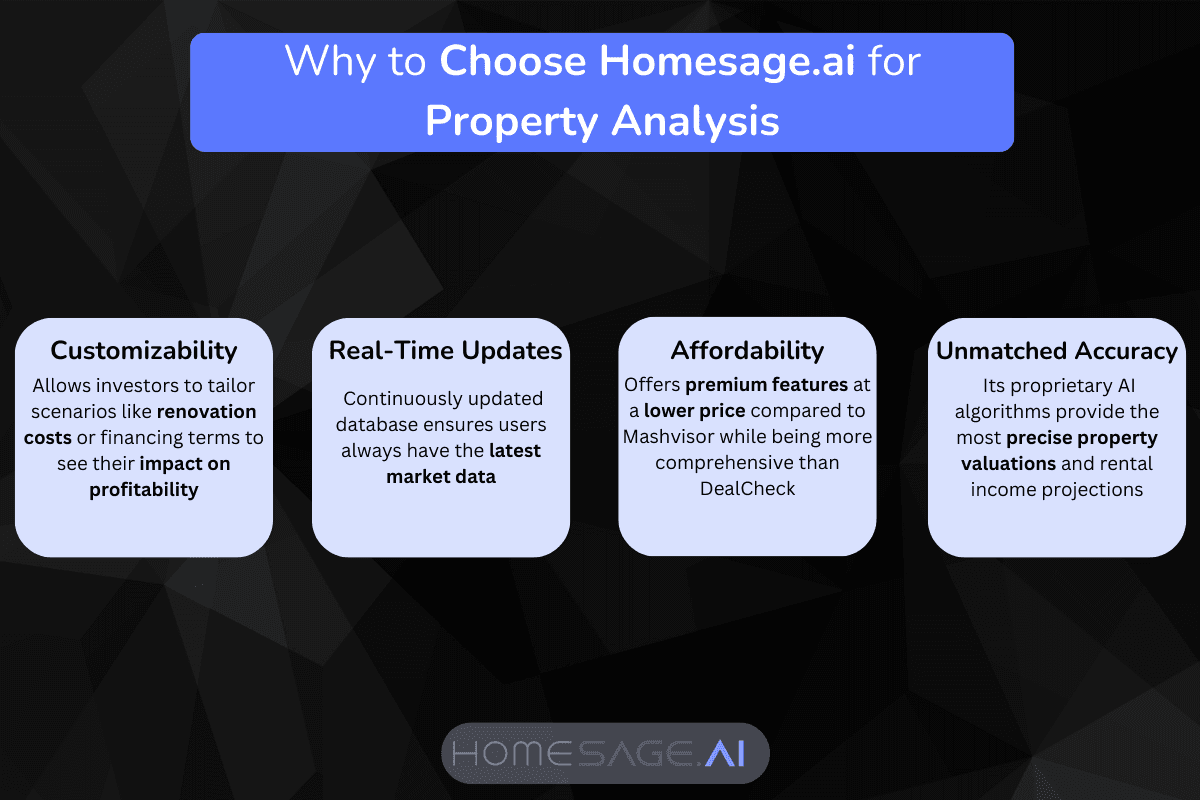

- Customizable Scenarios: Users can input variables like renovation costs or financing terms to see how they impact profitability.

Why Homesage.ai is a Market Leader

- Accuracy in Valuation: The platform’s AI-driven valuation engine ensures precise calculations that reflect real-time market conditions.

- Ease of Use: Homesage.ai is designed with simplicity in mind, making it accessible even for novice investors.

- Comprehensive Analysis: Unlike many competitors that focus solely on one aspect of property analysis (e.g., rental income), Homesage.ai offers a holistic view of investment performance.

- Real-Time Updates: The tool continuously updates its database to reflect changing market dynamics, ensuring users always have the most current information.

- Affordability: Homesage.ai offers robust features at a lower price point compared to competitors.

User Experience

Investors praise Homesage.ai for its intuitive interface and ability to deliver actionable insights quickly. The platform’s customizable features allow users to tailor analyses to their specific needs, making it a versatile tool for both short-term and long-term investment strategies.

2. Mashvisor

Mashvisor is another leading AI-powered tool designed for real estate investors seeking detailed property analysis with minimal effort.

Key Features

- Heatmaps for Market Trends: Mashvisor’s heatmaps visually represent areas with high rental demand or strong appreciation potential.

- Rental Property Calculator: This feature computes key metrics like cash flow, cap rate, and ROI based on user inputs.

- Neighborhood Analysis: Investors can dive deep into neighborhood-level data to understand demographics, average rents, vacancy rates, and more.

- Airbnb Insights: For those interested in short-term rentals, Mashvisor provides analytics specific to Airbnb properties.

Why Mashvisor Stands Out

- Visual Tools: The heatmaps make it easy for users to identify lucrative markets at a glance.

- Short-Term Rental Focus: Mashvisor’s Airbnb analytics cater specifically to investors exploring short-term rental opportunities.

- User-Friendly Interface: The platform simplifies complex calculations into digestible formats suitable for both experienced investors and beginners.

User Experience

Mashvisor is highly regarded for its ability to deliver actionable insights quickly without overwhelming users with excessive detail. Its visual tools are particularly useful for identifying trends in unfamiliar markets.

3. DealCheck

DealCheck rounds out the list as a powerful yet affordable option for real estate investors looking for comprehensive property analysis on-the-go.

Key Features

- Mobile-Friendly Design: DealCheck offers a mobile app that allows users to analyze properties anytime, anywhere.

- Investment Metrics Calculator: Users can compute metrics like cash-on-cash return, IRR (Internal Rate of Return), and break-even points effortlessly.

- Comparable Sales Data: The tool pulls data from multiple sources to provide accurate comps for valuation purposes.

Why DealCheck is Worth Considering

- Affordability: DealCheck offers robust features at a lower price point compared to competitors.

- Portability: Its mobile app makes it ideal for investors who need access to analysis while visiting properties or attending meetings.

User Experience

DealCheck’s straightforward interface ensures users can quickly input data and receive results without requiring extensive training or expertise.

Conclusion

AI-powered investment property analysis tools like Homesage.ai, Mashvisor, and DealCheck have transformed how real estate investors evaluate opportunities.

Homesage.ai leads the pack with its cutting-edge valuation engine and comprehensive features tailored for all types of investors.

By leveraging these tools, investors can make smarter decisions backed by accurate data and predictive insights—unlocking greater success in their real estate ventures.

Frequently Asked Questions (FAQs)

1. What are investment property analysis tools?

These tools help real estate investors review important data like property performance, projected returns, and market trends so they can make smarter investment choices based on facts rather than guesswork.

2. Why should I use AI-powered tools for property analysis?

AI tools process and analyze massive datasets in seconds, offering quick, accurate predictions about property values, rental income, and market shifts—capabilities that traditional methods can’t match.

3. Can AI tools help me spot risks before buying?

Yes. AI-powered platforms flag potential risks by forecasting expenses, highlighting local trends, and estimating future performance to help you avoid costly mistakes.

4. Are these tools suitable for beginners?

Absolutely. Most platforms like Homesage.ai and DealCheck are user-friendly, with dashboards and calculators designed for both seasoned investors and newcomers.