Learning how to run comps effectively has become a fundamental skill for modern real estate success.

Performing Comparative Market Analyses (CMAs), also known as “Running Comps,” has become essential for real estate professionals, as running comps with AI revolutionizes how real estate professionals determine property values.

The traditional process of comparing similar recently sold properties can be time-consuming and error-prone, but artificial intelligence is transforming this critical task into a streamlined, accurate, and efficient process.

The Challenge of Traditional Comp Analysis

Running real estate comps through traditional methods presents numerous obstacles that can significantly impact valuation accuracy.

The complexity extends beyond simple property comparison, especially in dynamic markets where conditions change rapidly.

Key Challenges in Traditional CMA

Traditional comparative market analysis faces several critical limitations that AI technology addresses:

- Data Collection Difficulties: Finding reliable, up-to-date property data across multiple sources often results in incomplete or inconsistent information

- Property Variability Management: Adjusting for differences in square footage, age, renovations, and unique features requires extensive expertise and judgment

- Time-Intensive Processes: Thorough CMAs can consume hours, particularly for unique properties or areas with limited comparable sales

- Market Volatility Impact: Rapidly changing market conditions can render previous comps obsolete within weeks

- Human Error Risk: Manual processes increase the likelihood of calculation mistakes and missed data points

These challenges become particularly pronounced in markets like Gaithersburg, MD, where local market trends fluctuate frequently.

How AI Transforms Comparative Market Analysis

AI-powered platforms like Homesage.ai address traditional CMA challenges through automation, advanced analytics, and real-time data processing.

Modern AI-powered platforms revolutionize how real estate professionals approach property valuation by introducing sophisticated algorithms and machine learning capabilities.

Automated Data Aggregation

AI systems automatically collect and consolidate data from multiple sources including MLS listings, public records, and off-market properties.

This comprehensive data aggregation ensures complete information sets without the time-intensive manual research traditionally required.

Real-Time Market Analysis

Advanced AI algorithms continuously analyze current market trends, providing up-to-date insights crucial for accurate valuations in fast-moving markets.

This real-time analysis capability ensures comps remain relevant and reflect current market conditions.

Intelligent Property Adjustments

AI evaluates property differences through advanced algorithms and image recognition technology, automatically calculating adjustments for renovations, condition variations, and unique features.

This automation reduces subjective interpretation and improves consistency across valuations.

Enhanced Speed and Efficiency

AI-powered platforms process vast amounts of data in minutes rather than hours, allowing real estate professionals to focus on client relationships and strategic activities. Industry reports indicate that AI implementation can improve operational efficiency by up to 40%.

Improved Accuracy Through Pattern Recognition

By analyzing patterns and trends across thousands of data points, AI reduces human error risk and delivers more precise valuations.

Machine learning algorithms continuously improve accuracy by learning from market patterns and historical data.

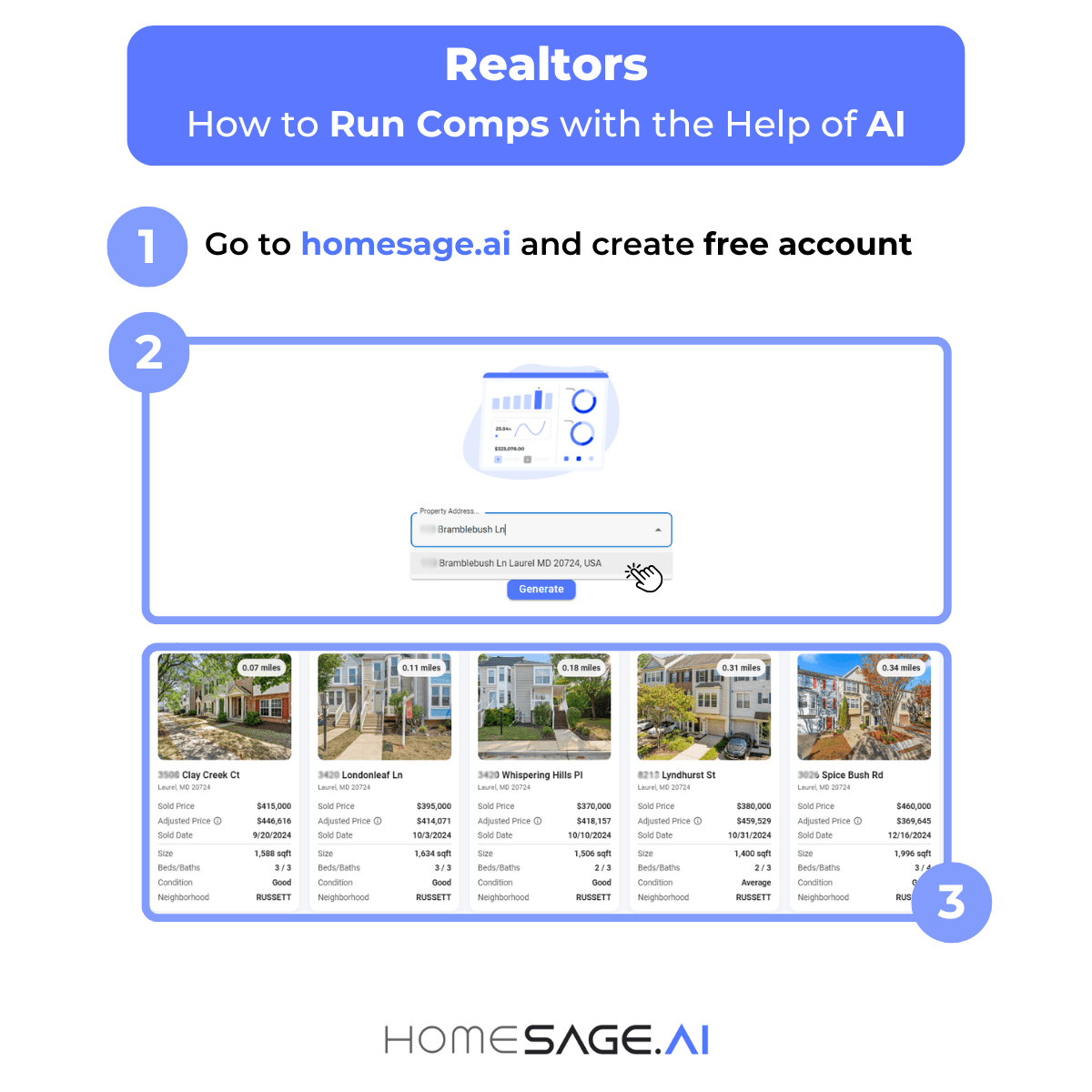

Step-by-Step Guide to AI-Powered Comp Analysis

Implementing AI for running comps involves strategic platform selection and systematic workflow integration.

Modern real estate professionals can leverage these tools to enhance their comparative market analysis processes significantly.

Step 1: Platform Selection and Setup

Choose a reliable AI-powered platform like Homesage.ai that offers comprehensive property data and advanced analytics capabilities.

Evaluate platforms based on data coverage, integration capabilities, and specific features relevant to your market area.

Step 2: Property Data Input and Analysis

Input subject property details, including location, square footage, bedrooms, bathrooms, and condition information.

AI systems use this baseline data to identify and evaluate comparable properties automatically.

Step 3: Comparable Property Identification

AI algorithms automatically identify suitable comparable properties based on proximity, similarity, and recent sale dates.

Advanced systems consider factors like property type, size variations, and market segment alignment.

Step 4: Automated Adjustment Calculations

AI systems calculate necessary adjustments for property differences, including condition variations, square footage discrepancies, and unique features. These calculations consider local market conditions and historical adjustment patterns.

Step 5: Market Trend Integration

Incorporate current market trends and economic factors into the valuation process through AI-powered market analysis.

This integration ensures valuations reflect current market dynamics rather than historical patterns alone.

Watch how Homesage.ai’s AI-powered comparable analysis works in practice, demonstrating transparent ARV calculations and automated property valuation:

Advanced AI Features in Modern CMA Tools

Contemporary AI platforms offer sophisticated features that extend beyond traditional comparative market analysis.

These advanced capabilities provide real estate professionals with comprehensive property insights and enhanced valuation accuracy.

Computer Vision Technology

Leading platforms utilize computer vision for precise property condition evaluation, analyzing uploaded property images to assess maintenance needs and improvement potential.

This technology provides objective condition assessments that inform accurate valuations.

After Repair Value (ARV) Calculations

AI systems calculate potential property values following renovations or improvements, essential for investment property analysis and renovation project planning.

ARV calculations consider improvement costs, market conditions, and comparable renovated properties.

Investment Potential Analysis

Built-in investment analysis models evaluate properties for rental potential, appreciation prospects, and overall investment viability.

These analyses benefit both agents working with investors and individual property purchasers considering investment potential.

Price Flexibility Scoring

Proprietary AI algorithms developed by homesage.ai analyze listing descriptions and property characteristics to predict seller negotiation flexibility. This insight provides valuable leverage during price negotiations and helps buyers understand realistic offer ranges.

Table 1: Traditional vs. AI-Powered CMA Methods

How to Run Comps: Traditional vs AI-Powered Comparison | Traditional Method | AI-Powered Method |

Data Collection Time | 1-2 hours manual research | 1-3 minutes automated aggregation |

Data Source Coverage | Limited to accessible databases | Comprehensive multi-source integration |

Adjustment Calculations | Manual calculations with error risk | Automated algorithms with pattern recognition |

Market Trend Integration | Periodic manual updates | Real-time continuous analysis |

Property Condition Assessment | Subjective visual evaluation | Computer vision objective analysis |

Report Generation Time | 1-2 hours formatting and compilation | Instant professional report generation |

Accuracy Consistency | Varies by agent experience | Standardized algorithm-based results |

Update Frequency | Manual periodic updates | Continuous real-time updates |

Table 2: AI-powered Real Estate CMA Platform Feature Comparison

Platform Feature | Homesage.ai | Traditional CMA Software | Generic AI Tools |

Computer Vision Assessment | Advanced image analysis | Not available | Limited capability |

ARV Calculations | Automated with cost estimation | Manual input required | Basic calculations only |

Price Flexibility Scoring | Proprietary AI analysis | Not available | Not available |

Real-time Market Data | Continuous updates | Periodic updates | Variable update frequency |

Investment Analysis | Comprehensive built-in models | Separate tools required | Limited analysis |

Multi-source Data Integration | 140+ million property database | MLS-dependent | Limited data sources |

Benefits of AI-Enhanced Comparative Market Analysis

Implementing AI technology for comparative market analysis provides substantial advantages that extend beyond time savings. These benefits transform how real estate professionals approach property valuation and client service.

Operational Efficiency Improvements

AI automation significantly reduces time spent on data collection and analysis tasks, allowing agents to handle more clients and transactions. Studies indicate operational efficiency improvements of up to 40% with AI implementation.

Enhanced Client Presentation Quality

AI-generated reports provide professional, data-backed presentations that impress clients and demonstrate expertise. These comprehensive reports include visual aids, market trend analysis, and detailed comparable property information.

Competitive Market Advantage

Leveraging advanced AI analytics provides agents with insights beyond traditional CMA methods, creating differentiation in competitive markets. Early AI adopters report improved client satisfaction and increased listing acquisition rates.

Reduced Error Risk and Liability

Automated calculations and data verification reduce human error risk, protecting agents from valuation mistakes that could impact transactions. Consistent, algorithm-based analysis provides defensible valuation methodologies.

Implementation Best Practices for AI CMA Tools

Successful AI CMA implementation requires strategic planning and systematic workflow integration. Real estate professionals should consider training requirements, client communication strategies, and quality assurance protocols.

Training and Skill Development

Invest time learning AI platform features and capabilities to maximize tool effectiveness. Understanding algorithm limitations and data interpretation ensures appropriate use of AI-generated insights.

Client Education and Communication

Educate clients about AI-enhanced valuation processes, emphasizing improved accuracy and comprehensive analysis capabilities. Transparent communication about methodology builds client confidence and trust.

Quality Assurance Protocols

Establish review processes for AI-generated reports, ensuring results align with local market knowledge and current conditions. Regular quality checks maintain accuracy standards and identify potential system limitations.

Future Trends in AI-Powered Real Estate Analysis

The integration of AI in real estate continues evolving with advancing technology and increasing industry adoption. Emerging trends indicate expanding capabilities and deeper market penetration across all real estate sectors.

Predictive Analytics Integration

Future AI systems will incorporate predictive analytics for property value forecasting and market trend anticipation. These capabilities will enable proactive market positioning and strategic investment planning.

Enhanced Personalization

AI platforms will offer increasingly personalized analysis based on agent preferences, client profiles, and local market characteristics. Customization capabilities will improve user experience and analysis relevance.

Expanded Data Integration

Future platforms will integrate additional data sources, including social media trends, economic indicators, and demographic shifts, for comprehensive market analysis. This expanded integration will provide deeper market insights and improved valuation accuracy.

Key Takeaways

Running comps with AI transforms traditional comparative market analysis through automation, enhanced accuracy, and comprehensive data integration. Modern AI platforms eliminate time-intensive manual processes while providing superior analytical capabilities.

- AI automation reduces CMA completion time from hours to minutes while improving accuracy through comprehensive data analysis

- Advanced features like computer vision, ARV calculations, and price flexibility scoring provide insights beyond traditional methods

- Successful implementation requires platform selection, training investment, and quality assurance protocols

- AI enhances rather than replaces agent expertise, creating opportunities for improved client service and competitive advantage

- Future developments will expand predictive capabilities and personalization for even greater analytical precision

Conclusion

The adoption of AI technology for comparative market analysis represents a fundamental shift in real estate practice, offering significant benefits for agents willing to embrace technological advancement.

As the industry continues evolving, AI-powered tools like homesage.ai will become increasingly essential for maintaining a competitive advantage and delivering superior client service.

Real estate professionals leveraging AI for comparative market analysis can provide faster, more accurate, and more comprehensive property valuations while dedicating more time to client relationships and strategic business development.

The integration of artificial intelligence into real estate practice represents both an opportunity and a necessity for forward-thinking professionals in today’s competitive market environment.

People Also Ask: Common CMA Questions

How accurate are AI-generated real estate comps compared to manual analysis?

AI-generated comps typically achieve higher accuracy than manual analysis due to comprehensive data integration and elimination of human calculation errors.

AI systems analyze thousands of data points simultaneously, identifying patterns that manual analysis might miss.

However, local market knowledge and agent expertise remain valuable for interpreting results and making final valuation decisions.

What data sources do AI CMA tools use for property comparisons?

AI CMA tools integrate multiple data sources, including MLS databases, public records, tax assessments, recent sales data, and property listing information.

Advanced platforms like Homesage.ai access databases containing over 140 million property records, ensuring comprehensive comparable property identification.

Some systems also incorporate rental data, neighborhood demographic information, and local market trend indicators.

Can AI CMA tools replace real estate agents for property valuations?

AI CMA tools enhance rather than replace real estate agent expertise in property valuations. While AI automates data collection and basic analysis, agents provide essential local market knowledge, negotiation insights, and client relationship management.

The most effective approach combines AI efficiency with human expertise for comprehensive property valuation services.