Introduction

An important question in real estate investing has always been: should I flip this property for quick profit or hold it as a rental for long-term income? This fundamental “Flip or Rent” decision can make or break an investment strategy.

With the help of AI-powered systems like Homesage.ai, this decision no longer requires guesswork, extensive spreadsheets, or countless hours of market research.

AI has revolutionized how investors analyze properties, predict returns, and make strategic decisions between flipping and rental investments.

The Evolution of Real Estate Investment Analysis

Traditional property analysis required investors to manually research comparable sales, estimate renovation costs, and calculate rental potential through time-consuming processes that often led to inaccurate projections.

Today’s AI-powered platforms have transformed this landscape by processing vast amounts of data instantly and providing actionable insights that would take human analysts days or weeks to compile.

AI eliminates the guesswork from investment decisions by analyzing multiple variables simultaneously, including market trends, property conditions, neighborhood dynamics, and financial projections. These systems continuously learn from new data, refining their accuracy and providing increasingly reliable investment recommendations.

How AI Enhances Investment Decision-Making

Automated Property Valuation

AI-powered valuation engines analyze comparable sales, market conditions, and property characteristics to provide accurate valuations in real-time. These systems consider factors that human analysts might overlook, such as subtle neighborhood trends, seasonal market fluctuations, and micro-location advantages.

Predictive Market Analysis

Modern AI platforms forecast future property values and rental demand with remarkable accuracy. By analyzing historical data patterns, economic indicators, and local market dynamics, these tools help investors understand both short-term flip potential and long-term rental viability.

Risk Assessment and Mitigation

AI systems evaluate investment risks by analyzing factors like market volatility, neighborhood stability, and property-specific concerns. This comprehensive risk analysis helps investors make informed decisions about whether a property is better suited for flipping or rental investment.

AI-Powered Tools for Flip vs Rental Analysis

The real estate technology landscape now offers sophisticated platforms that specialize in helping investors make the critical flip-versus-rental decision. These tools leverage machine learning algorithms to process multiple data points and deliver comprehensive investment analysis.

Key Features of Modern AI Analysis Platforms

- Automated Renovation Cost Estimation: AI platforms can analyze property photos and condition reports to estimate renovation costs without requiring on-site visits. This capability is particularly valuable for remote investors or those evaluating multiple properties quickly.

- Multi-Strategy ROI Calculations: Advanced systems calculate returns for various investment strategies simultaneously, allowing investors to compare flip potential against rental income projections for the same property.

- Market Timing Insights: AI tools analyze market cycles and timing factors to recommend optimal exit strategies, helping investors understand whether current conditions favor flipping or long-term holding.

Homesage.ai: Leading the AI Revolution in Real Estate Investment

Homesage.ai stands at the forefront of AI-powered real estate analysis, offering comprehensive tools specifically designed to help investors make informed flip-versus-rental decisions. The platform’s advanced algorithms analyze over 140 million U.S. residential properties, providing instant insights that transform how investors approach property evaluation.

The platform also analyses all new listings that come on the market in the United States on a daily basis, including Off-market and MLS properties, and provides rental vs. flip analysis for each listing.

Investment Property Search Engine

Homesage.ai’s Investment Property Search tool identifies properties with the highest potential for both flipping and rental strategies. The AI system evaluates multiple factors including:

- Property condition and renovation requirements.

- Local market appreciation trends.

- Rental demand and income potential.

- Price flexibility and negotiation opportunities.

- Neighborhood investment characteristics.

This comprehensive analysis allows investors to quickly identify properties that offer the best returns for their preferred investment strategy, whether that’s flipping for quick profits or acquiring rental properties for long-term cash flow.

Full Property Reports for Comprehensive Analysis

The platform’s Full Property Reports feature delivers instant, detailed analysis for any U.S. property, combining multiple AI-powered insights into a single comprehensive document. These reports include:

Flip Analysis Components:

- After Repair Value (ARV) projections.

- Renovation cost estimates and ROI calculations.

- Market timing recommendations.

- Comparable sales analysis.

- Price negotiation insights through Price Flexibility Score.

Rental Investment Analysis:

- Long-term rental income predictions.

- Short-term rental potential for Airbnb properties.

- Cash flow projections and cap rate calculations.

- Occupancy rate forecasts.

- Market rent comparisons.

Advanced AI Features for Strategic Decision-Making

Homesage.ai‘s platform includes several proprietary AI-driven features that set it apart from traditional analysis tools:

- Computer Vision Property Assessment: The platform uses advanced computer vision technology to analyze property photos and automatically assess condition ratings, identifying properties that may require significant renovation investment.

- Price Flexibility Score: This unique AI-powered metric analyzes listing behavior, market conditions, and seller motivation to predict negotiation potential, helping investors identify properties where they can secure better purchase prices.

- Investment Potential Scoring: The AI system generates investment potential scores based on multiple property attributes and market factors, helping investors quickly identify properties with the highest profit potential.

Strategic Considerations for Flip vs Rental Decisions

Capital Requirements and Timeline Factors

- Flipping Properties: Requires significant upfront capital for purchase, renovation, and carrying costs during the flip period. AI tools help investors accurately estimate total project costs and timeline requirements, reducing the risk of budget overruns that can eliminate profits.

- Rental Properties: Typically requires less upfront renovation investment but demands ongoing management and maintenance. AI platforms analyze long-term market trends to help investors understand whether rental income will grow over time and provide adequate returns on investment.

Market Conditions and Timing

AI analysis reveals crucial market timing factors that influence flip-versus-rental decisions:

Rising Markets: May favor flipping strategies due to rapid appreciation potential

Stable Markets: Often better suited for rental investments with steady cash flow

Declining Markets: Require careful AI analysis to identify properties with resilience potential

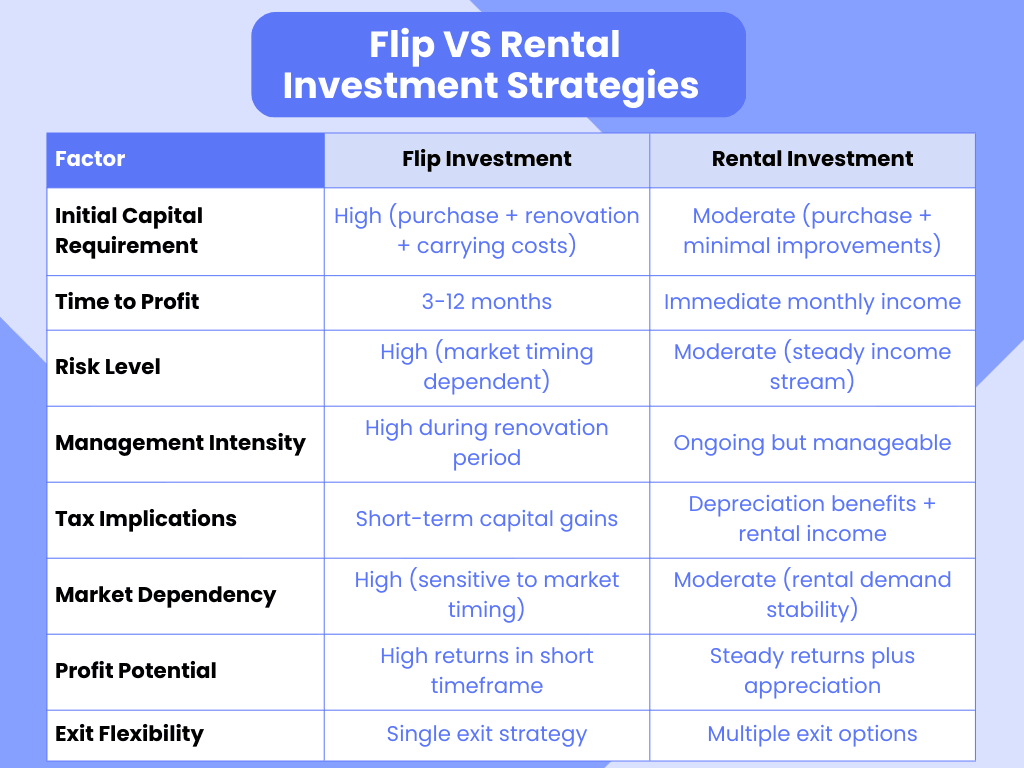

Table 1: Comparative Analysis: Flip or Rental Investment Strategies

Factor | Flip Investment | Rental Investment |

Initial Capital Requirement | High (purchase + renovation + carrying costs) | Moderate (purchase + minimal improvements) |

Time to Profit | 3-12 months | Immediate monthly income |

Risk Level | High (market timing dependent) | Moderate (steady income stream) |

Management Intensity | High during renovation period | Ongoing but manageable |

Tax Implications | Short-term capital gains | Depreciation benefits + rental income |

Market Dependency | High (sensitive to market timing) | Moderate (rental demand stability) |

Profit Potential | High returns in short timeframe | Steady returns plus appreciation |

Exit Flexibility | Single exit strategy | Multiple exit options |

AI-Driven Financial Modeling and ROI Optimization

Advanced Return Calculations

Modern AI platforms perform complex financial modeling that considers numerous variables affecting investment returns. These calculations include:

- Construction and renovation cost fluctuations.

- Local market appreciation rates.

- Rental income growth projections.

- Tax implications and depreciation benefits.

- Financing options and interest rate impacts.

Risk-Adjusted Return Analysis

AI systems provide risk-adjusted return calculations that help investors understand not just potential profits, but the likelihood of achieving those returns. This analysis considers market volatility, property-specific risks, and economic factors that could impact investment performance.

Implementation Strategies for AI-Powered Investment Decisions

Setting Up Automated Property Screening

Successful investors leverage AI platforms to create automated screening processes that identify properties meeting specific investment criteria. Homesage.ai‘s Investment Property Search allows investors to set parameters for both flip and rental strategies, receiving daily updates on properties that match their requirements.

Combining AI Insights with Local Market Knowledge

While AI provides powerful data analysis capabilities, successful investors combine these insights with local market knowledge and personal investment goals. AI platforms serve as decision support tools that enhance rather than replace investor judgment and experience.

Key Benefits of AI-Powered Investment Analysis

Speed and Efficiency Advantages

Traditional Analysis: Could take days or weeks to properly evaluate a single property

AI-Powered Analysis: Provides comprehensive investment analysis in seconds

Accuracy and Data-Driven Insights

AI platforms process vastly more data points than human analysis alone, considering factors like:

- Historical price trends and market cycles.

- Neighborhood demographic changes.

- Economic indicators and employment data.

- Seasonal market variations.

- Comparable property analysis across multiple timeframes.

Scalability for Portfolio Growth

AI tools enable investors to analyze multiple properties simultaneously, making it feasible to evaluate larger numbers of potential investments and build diversified portfolios more efficiently.

Market Trends and AI Predictions

Future of AI in Real Estate Investment

The integration of AI in real estate investment continues evolving, with emerging capabilities including:

Predictive Maintenance for Rentals: AI systems that forecast maintenance needs and costs for rental properties, improving cash flow predictions and management efficiency.

Dynamic Pricing Optimization: Advanced algorithms that automatically adjust rental prices based on market conditions, seasonality, and demand patterns.

Portfolio Optimization: AI tools that analyze entire investment portfolios to recommend optimal allocation between flips, long-term rentals, and other investment strategies.

Key Takeaways

- AI-powered platforms like Homesage.ai analyze 140+ million properties to provide instant investment insights for both flipping and rental strategies.

- Modern AI tools estimate renovation costs, predict rental income, and calculate ROI without requiring property visits.

- Homesage.ai‘s Full Property Reports deliver comprehensive analysis including flip potential, rental estimates, and market comparisons in seconds.

- AI-driven Investment Property Search identifies high-potential deals based on multi-factor analysis and market conditions.

- Advanced algorithms consider local market trends, property conditions, and financial projections to optimize investment decisions.

Conclusion

The decision between flipping and rental investment no longer requires extensive manual research or gut instinct. AI-powered platforms like Homesage.ai have democratized access to sophisticated investment analysis, enabling investors of all experience levels to make data-driven decisions with confidence.

In addition to helping investors, Homesage.ai also rewards affiliates. With commissions of up to 40%, the program creates another income stream for those looking to leverage real estate technology. Discover the full details in this article.

By leveraging AI tools that analyze millions of data points instantly, investors can identify the most profitable strategy for each property opportunity.

Discover how Homesage.ai helps investors uncover high-potential properties with this video.

Whether you’re seeking quick profits through flipping or building long-term wealth through rental properties, AI provides the insights needed to maximize returns while minimizing risks.

The future of real estate investment belongs to those who embrace these technological advantages, using AI as a powerful ally in building successful property portfolios. As these platforms continue evolving and improving their accuracy, investors who integrate AI analysis into their decision-making process will maintain significant competitive advantages in an increasingly data-driven market.

Frequently Asked Questions

Q: How accurate is AI in predicting property flip vs rental returns?

A: AI platforms like Homesage.ai achieve high accuracy rates by analyzing millions of data points including historical sales, market trends, and comparable properties. While no prediction system is 100% accurate, AI-powered analysis significantly outperforms traditional manual methods by considering more variables and continuously learning from new market data.

The accuracy improves over time as the algorithms process more transactions and market outcomes.

Q: Can AI replace the need for professional real estate investment advice?

A: AI serves as a powerful decision support tool rather than a replacement for professional advice. While AI platforms provide comprehensive data analysis and investment projections, they work best when combined with local market knowledge, professional expertise, and individual investment goals.

Successful investors use AI to enhance their decision-making process while still consulting with real estate professionals, tax advisors, and other experts for complex investment strategies.

Q: What types of properties work best with AI analysis for flip vs rental decisions?

A: AI analysis is most effective with residential properties that have sufficient comparable sales data and market history. Single-family homes, condominiums, and small multifamily properties typically provide the best results for AI analysis.

The platforms work well in established markets with regular transaction activity, though newer AI systems are increasingly capable of analyzing properties in emerging markets by using broader regional data and predictive modeling techniques.

4 Comments

Peter September 23, 2025

Very helpful for investors!

Jasmine Elias September 23, 2025

Nice blog for critical investment decisions. Thanks for the info.

N September 24, 2025

Informative!

Mohamed September 24, 2025

Love this!