Introduction

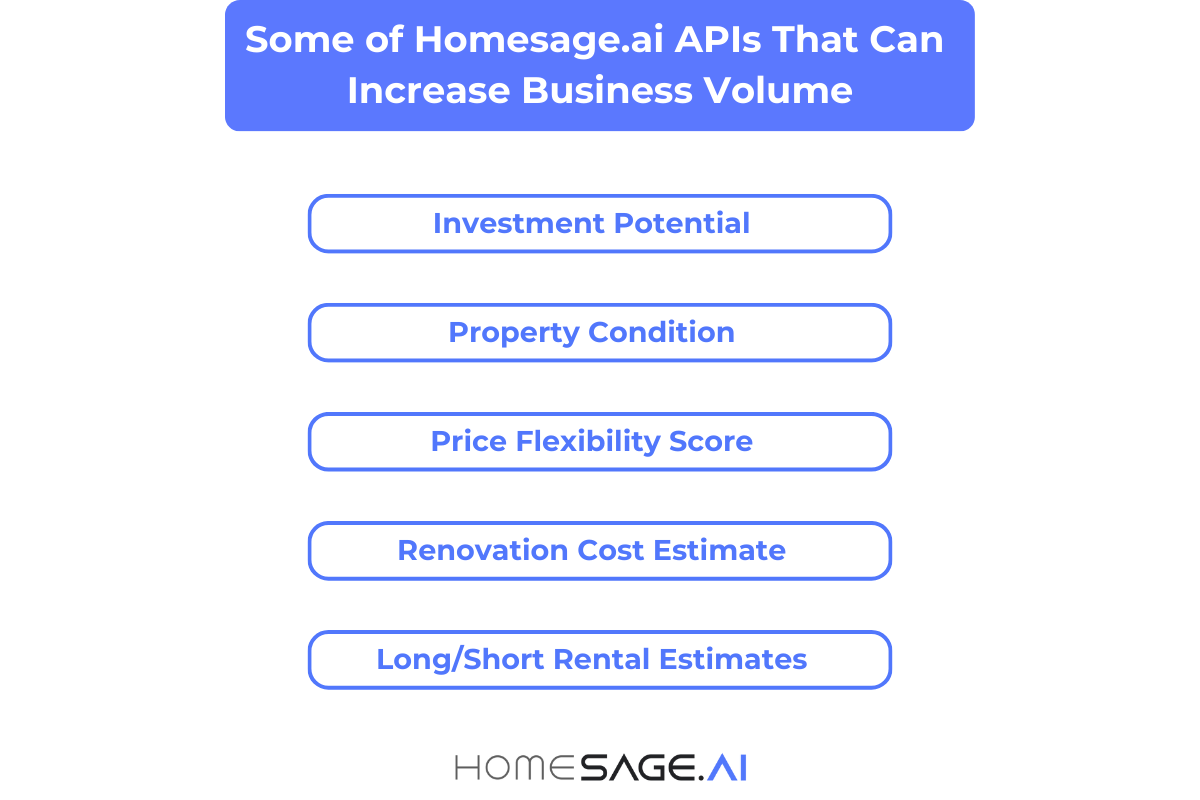

In the fast-paced realm of real estate investment, hard and private money lenders are constantly on the lookout for innovative tools to expand their deal volume and enhance their portfolio strength. Homesage.ai stands out as a pivotal force, providing AI-powered solutions specifically tailored for the hard money and private money lending industries.

By leveraging cutting-edge technology, Homesage.ai equips lenders with the capability to identify lucrative opportunities, share them with clients, accurately assess risks, and consequently drive higher returns.

What is an API?

API stands for Application Programming Interface, a term that may sound complex, but its principle is relatively straightforward. An API is a set of rules and protocols expressed in a short code snippet for building and interacting with software applications.

It acts as a bridge between different software programs, allowing them to communicate with each other without needing to know how they’re implemented.

In the context of real estate and hard money lending, an API can be thought of as a messenger that sends your request to a system and then returns the system’s response back to you.

For instance, when lenders use APIs, they’re able to request data about property values, investment potential, or renovation costs, and receive accurate, algorithm-driven insights in return. This enables lenders to automate and enhance various aspects of their decision-making processes, from assessing the value of a property to estimating potential returns on investment.

Explore this API overview or Homesage.ai docs section for integration details.

1. Investment Property Lists

Homesage.ai’s AI models scan all new listings that come on the market daily, resulting in unique and actionable information for lenders and their clients.

Utilizing AI, these lists are generated daily, allowing lenders to customize their search according to specific market segments, such as property conditions and investment potential.

This not only streamlines the property-finding process but also amplifies the effectiveness of marketing efforts, ensuring lenders focus on the most promising prospects.

Key benefits of Investment Property Lists:

- Daily AI-generated updates on high-potential properties.

- Custom filters for targeted market segments.

- Actionable insights to boost deal volume.

- Seamless integration for client sharing.

Check this investment lists guide and our products page.

2. Deal Value

This model takes into consideration more than 30 metrics and assesses the Deal Value for each new listing.

With an automated valuation model and a predictive after-repair value metric, lenders and their clients can gauge the current and potential future value of properties.

This data is critical in determining the deal value and ensuring that lenders can identify investments with the best possible returns.

3. Property Condition

Homesage.ai’s computer vision models detect the physical condition of each listing. The output is fed to additional AI models, resulting in an output that would probably take hours if done manually.

Learn about AI lending solutions in our hard money lenders blog.

4. Price Flexibility Score

The Price Flexibility Score provided by Homesage.ai is a crucial metric for lenders. It assesses the potential for price negotiation.

A higher score indicates a better chance of negotiating a lower price, making it a valuable tool for prioritizing investment opportunities.

Core features of Price Flexibility Score:

- Real-time negotiation insights.

- Prioritization of high-potential deals.

- Integration with risk assessment tools.

- Enhanced portfolio decision-making.

5. Renovation Cost

Understanding the potential costs of renovation is crucial in real estate investment. The Renovation Cost Estimate API delivers an automated prediction of these costs, helping lenders factor them into their overall investment strategy and analyze the feasibility of a property’s renovation to enhance its value.

Read this renovation cost calculator or visit Homesage.ai home improvement API page.

6. Fix and Flip Returns

The process of estimating returns on fix-and-flip investments is streamlined by Homesage.ai’s APIs.

These tools offer real-time data and predictive analytics, which allow lenders and their clients to swiftly assess the potential returns on investment, reducing the time spent on manual research and hastening the decision-making process.

Discover fix-and-flip statistics and our best real estate APIs blog.

7. Long and Short-term Rental Estimates

Homesage.ai also caters to lenders interested in rental investments with its projections on long-term and short-term rental revenues.

This feature aids lenders in determining the rental potential of a property, informing their decisions on whether a property is a suitable candidate for funding as a rental investment.

Key advantages for rental estimates:

- Projections for both long and short-term revenues.

- Informed funding decisions for rentals.

- Real-time market alignment.

- Portfolio enhancement through diversified insights.

Explore AI in lending trends or our investment workflow blog.

Conclusion

Homesage.ai transcends the role of a mere technology provider, positioning itself as an indispensable strategic partner for those navigating the complex currents of the real estate investment market.

By harnessing the robust power of AI, Homesage.ai arms hard and private money lenders with a suite of analytical tools that go beyond surface-level data, offering deep, actionable insights that are critical in today’s competitive landscape.

Whether it’s through fine-tuning investment strategies, enhancing due diligence, or tailoring lending practices, the platform’s offerings ensure that lenders can operate with a level of precision and foresight that was previously unattainable.

The transformative success stories of lenders who have integrated Homesage.ai into their workflows stand as a testament to the platform’s ability to redefine the industry standard and lead the charge towards a future where data-driven decision-making is the cornerstone of investment success.

For more on hard money trends and Homesage.ai API developers page.

Frequently Asked Questions (FAQs):

What is an API in real estate lending?

An API enables software communication for data like property values and returns. Explore this API overview or Homesage.ai docs.

How do Investment Property Lists work?

They provide daily AI-scanned lists of high-potential properties for customization. Check our products page and this investment lists article.

What does Renovation Cost API offer?

It predicts renovation expenses for investment feasibility. Use Homesage.ai home improvement API or read this renovation calculator guide.

How does Fix and Flip Returns help?

It streamlines return estimates with real-time analytics. Access our best APIs blog and this fix-and-flip statistics.

What are Rental Estimates for?

They project revenues for long and short-term rentals to guide funding. Learn from this AI lending trends or our investment workflow blog.