Due diligence delays cost lenders deals, credibility, and market share.

In 2025, forward-thinking lending institutions are turning to real estate data APIs to transform underwriting workflows from days-long bottlenecks into automated, data-driven systems that close loans faster and more accurately.

These APIs provide instant access to verified property intelligence, automated valuations, and granular risk assessments in seconds rather than hours. For modern lenders, this marks a fundamental shift in how collateral is evaluated, risk is managed, and borrowers are served.

The Due Diligence Challenge Facing Modern Lenders

Traditional due diligence relies heavily on manual data collection, disconnected sources, and time‑consuming verification steps. Studies show that underwriters spend up to 30% of their time gathering property data instead of analyzing risk or making informed decisions.

This inefficiency creates delays, inconsistent valuations, and borrower frustration. Loan officers struggle with timelines, while competitors with digital workflows close deals faster. Manual processes also increase error rates and expose institutions to fraud. When valuations shift between prequalification and underwriting, borrower trust declines, often leading to loan fallout.

AI-powered platforms like Homesage.ai aim to address many of the pain points lenders face daily.

Key Pain Points in Traditional Due Diligence

Manual due diligence creates four primary challenges:

- Data Collection Delays: Manually extracting property records, ownership histories, and comparable sales consumes hours of staff time.

- Valuation Inconsistencies: Prices often change due to underwriting, which harms credibility with clients.

- Limited Market Visibility: Static historical data fails to reflect real‑time market dynamics.

- Compliance Complexity: Manual verification of KYC and AML requirements adds cost and legal risk.

What Real Estate Data APIs Deliver to Lenders

Real estate data APIs connect lending platforms directly to live data streams from property databases, valuation models, and third‑party analytics. Instead of manually downloading or requesting property reports, loan officers can query APIs to retrieve standardized data instantly.

Modern APIs provide rich datasets, property characteristics and insights, transaction histories, market comps, tax records, risk scores, and predictive modeling. Leading platforms like Homesage.ai deliver updated intelligence on more than 140 million U.S. properties, keeping every decision fact‑based and current.

This video shows how lenders use Homesage.ai to increase sales:

Core Capabilities That Transform Lending Operations

APIs unlock key functions that accelerate and strengthen the underwriting process.

- Automated Valuation Models (AVMs) generate property valuations within seconds by analyzing comparable sales and market performance, cutting appraisal cycle time from days to minutes.

- Property Condition Analysis uses AI to review property images and assess quality or needed repairs, often detecting issues before physical inspections.

- Risk Scoring and Analytics unify dozens of variables, crime data, environmental exposure, and title records into a single risk profile, enabling more intelligent, faster workflow approvals.

- Renovation Cost Estimates calculates likely repair costs for older homes, supporting more accurate loan‑to‑value ratios and budget planning.

- Rental Income Projections forecast long‑term and short‑term rental potential to guide investment property underwriting decisions.

These capabilities reduce repetitive tasks and minimize human error by consolidating diverse data sources into a single, consistent decision framework.

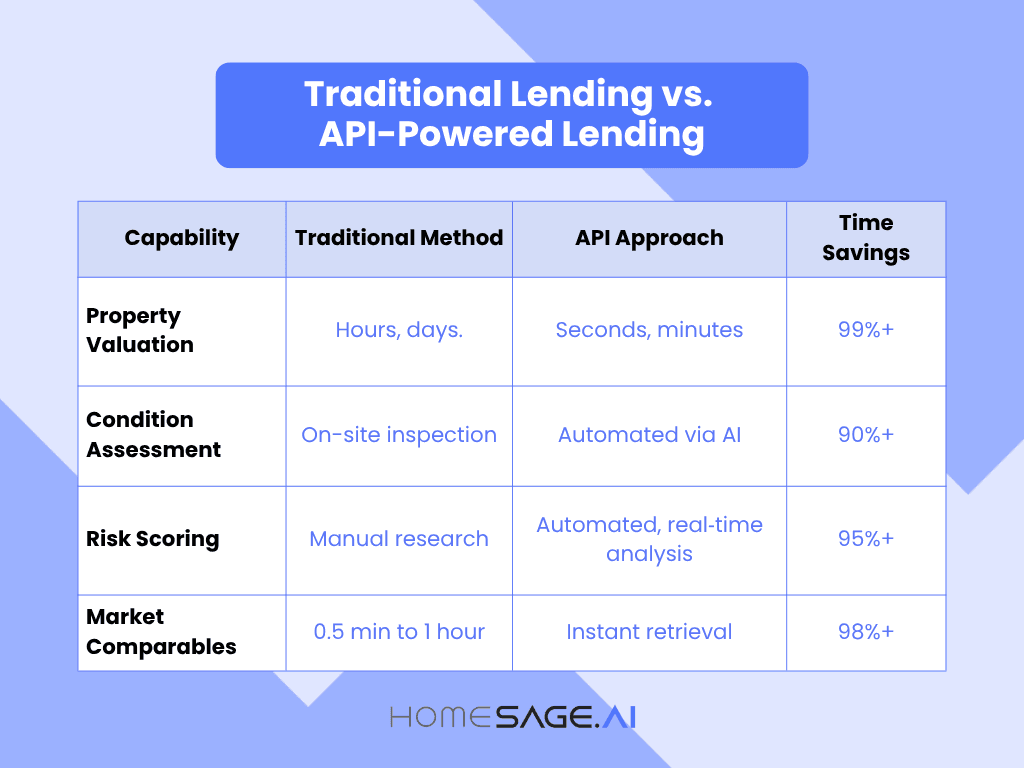

Traditional vs API‑Enabled Due Diligence

Capability | Traditional Method | API Approach | Time Savings |

Property Valuation | Hours, days. | Seconds, minutes | 99%+ |

Condition Assessment | Requires physical inspection | Automated via AI | 90%+ |

Risk Scoring | Manual research | Automated, real‑time analysis | 95%+ |

Market Comparables | 0.5 to 1 hour | Instant retrieval | 98%+ |

Faster Decisions, Stronger Competitive Advantage

API‑driven automation redefines lending speed. Institutions adopting these solutions report up to 90% faster processing times and approval cycles reduced from weeks to hours.

APIs run parallel processes, pulling financial data, verifying assets, assessing valuation, and screening for compliance simultaneously. This eliminates linear, step‑by‑step delays and creates continuous digital workflows.

Real‑World Performance Gains

- Lenders reduce loan processing time from weeks to minutes or hours by integrating API data feeds.

- Home‑equity lenders using property-analytics APIs now maintain valuation consistency from prequal to closing.

- Digital asset verification enables lenders to process up to 3 times as many loans with a 30% shorter turnaround time.

The Compounding Benefit of Operational Velocity

Speed does more than impress borrowers—it transforms economics. Automated workflows enable lenders to manage 150–250% higher application volumes without hiring additional staff. Organizations also report 40–60% lower operating costs due to reduced manual input and rework.

Faster response times strengthen borrower loyalty and mitigate lead drop‑off. In competitive markets, the lender that closes faster secures the relationship.

Enhanced Risk Assessment and Portfolio Quality

Speed alone is not enough; accuracy defines long‑term success. Real estate data APIs offer richer risk visibility than manual methods could ever provide. Lenders uncover hidden red flags and promising investment opportunities by merging property-level data with predictive analytics.

AI‑driven risk scoring analyzes patterns in borrower behavior, local market conditions, and economic shifts, helping lenders align terms with their actual risk tolerance.

Proactive Risk Identification

APIs now deliver early‑warning intelligence across multiple factors:

- Environmental Hazards: Flood, fire, seismic, and climate exposure data.

- Market Stability: Property value trends, neighborhood growth, and shifts in inventory.

- Title and Lien Issues: Outstanding liens or ownership conflicts detected before underwriting.

- Default Prediction: Machine learning identifies high‑risk applications based on market and borrower indicators.

This integrated approach improves screening accuracy, ensuring only viable loans reach underwriters.

Portfolio Optimization Through Real Estate Data Intelligence

The cumulative result of smarter loan decisions is stronger overall portfolio performance. Lenders leveraging AI-powered property analytics report 30–50% lower default rates and higher long-term returns through better asset selection.

Advanced models can identify undervalued or high‑growth neighborhoods early, using demographic and infrastructure data that manual reviews often miss.

Compliance Automation and Regulatory Confidence

Compliance is one of lending’s costliest pain points. APIs simplify oversight by embedding verification and documentation within the workflow.

Real‑time checks ensure instant compliance with regulations like KYC and AML, reducing exposure to penalties. Automated audit trails record every decision, making oversight and reporting effortless.

Consistency and Standardization

By embedding lending rules directly into digital workflows, APIs ensure consistent policy application across branches or jurisdictions. Institutions operating in multiple states can automatically adjust to local requirements without manual review.

This consistency builds regulatory confidence and dramatically cuts the time needed for audits.

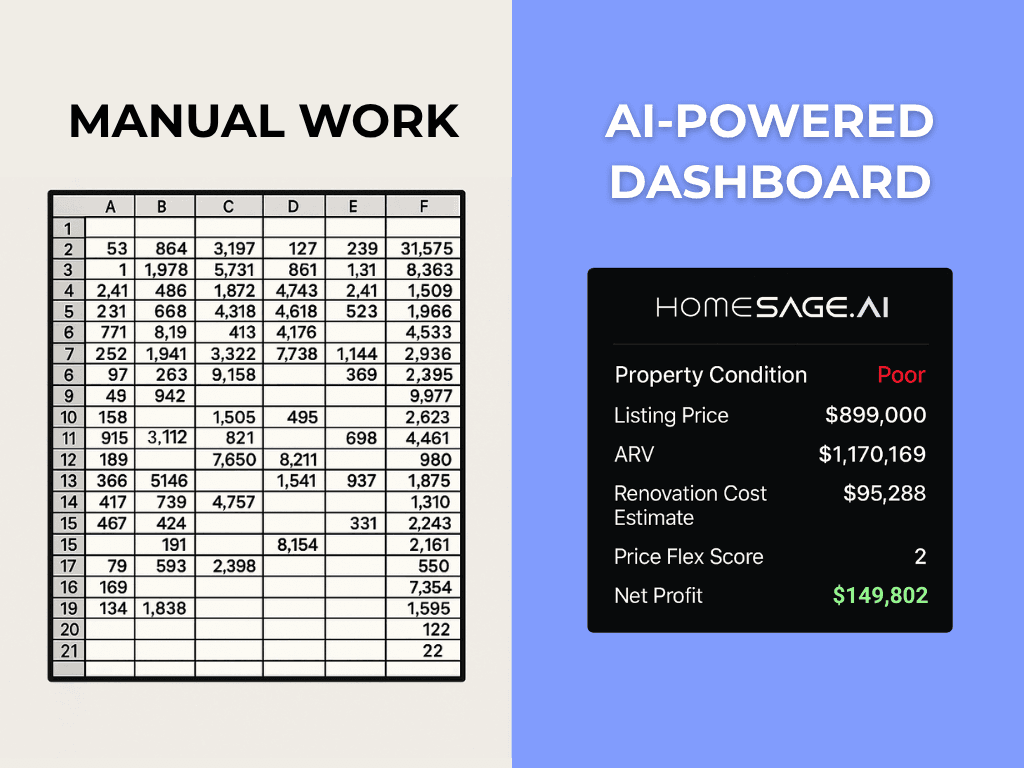

Cost Reduction Through Intelligent Data Automation

The financial case for API adoption is compelling. APIs free staff from repetitive tasks, cut document handling costs, and reduce rework through data accuracy.

Organizations adopting property data automation achieve:

- 60–80% less time spent on property analysis.

- 40–60% reduction in operational costs.

- 200–300% higher processing capacity with existing teams.

With mortgage origination costs sometimes surpassing $10,000 per loan, automated data retrieval significantly boosts profit margins. APIs that verify assets directly through financial institutions also reduce fraud risk, an issue that grew more than 8% last year.

Data Integration and Implementation Best Practices

Adopting APIs is not only about access; it’s about integration strategy. Effective rollouts begin with a focused use case (e.g., valuation automation) and expand step by step.

Modern APIs use RESTful architecture compatible with most loan origination systems, often leveraging JSON or XML formats for seamless data flow. Many providers offer sandbox environments, SDKs, and detailed documentation for fast onboarding.

Key Data Integration Priorities

- Security: Encryption, authentication, and privacy compliance are non‑negotiable.

- Scalability: Infrastructure must handle increasing transaction loads with minimal latency.

- Data Consistency: Uniform formats ensure interoperability across systems.

- Vendor Reliability: Evaluate providers for uptime performance and support responsiveness.

Selecting the Right API Partner

Not all APIs deliver equal value. Lenders should assess vendors according to:

- Coverage and Accuracy: Nationwide property data is refreshed daily, ensuring reliability.

- Analytical Depth: APIs that include AI‑driven insights add predictive power beyond static data.

- Developer Support: Strong technical documentation and trial environments streamline integration.

- Transparent Pricing: Clear usage models reduce cost uncertainty.

Platforms like Homesage.ai combine property valuations, renovation cost insights, rental projections, and investment scoring within a single accessible system, empowering lenders to act faster while reducing risk exposure.

This video shows how to use Real estate APIs and seamlessly integrate them into your workflow:

The Competitive Imperative for 2025

As API adoption accelerates, early adopters are redefining the market. Lenders using real‑time data outperform peers in speed, accuracy, and borrower satisfaction; those who delay risk being left behind as digital mortgage operations capture an ever‑larger share of volume.

The digital mortgage sector is expected to grow from $108 billion in 2024 to over $740 billion by 2033, underscoring the industry’s irreversible shift toward automation. FinTech lenders already process loans 9–14 days faster than traditional players, a lead likely to widen as API ecosystems expand.

The message is clear: speed, precision, and automation are no longer optional; they are competitive necessities.

How Homesage.ai APIs Empower Lending Institutions

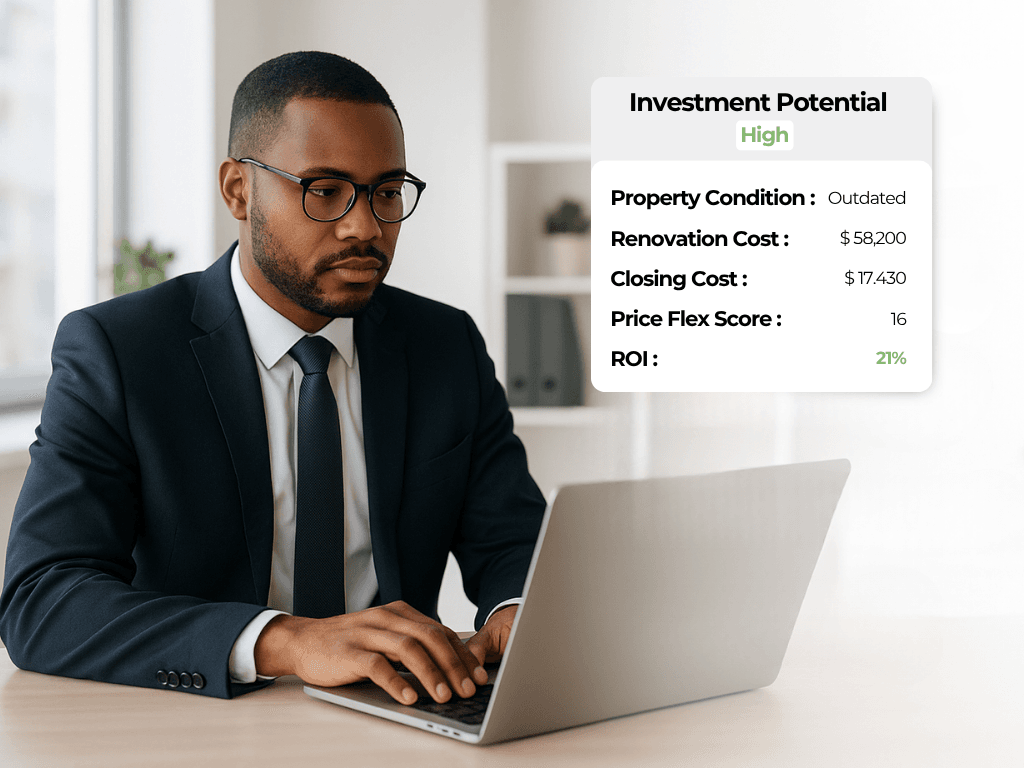

Homesage.ai equips lenders with an integrated property intelligence infrastructure that drives faster, data‑backed decisions.

- Property Information API instantly delivers detailed property metrics, including price, size, and features. The

- Property Condition API uses AI to assess property condition from listing photos.

- Renovation Cost API estimates refurbishment costs to improve loan accuracy.

- Investment Potential API identifies profitable opportunities with quantified ROI.

- The Rental APIs project provides long‑ and short‑term rental income across markets.

- Full Property Report consolidates these insights into one dynamic view for underwriting teams.

Together, these tools streamline due diligence, eliminate data blind spots, and help lending professionals manage portfolios precisely and quickly.

Key Takeaways

- Real estate data APIs transform lender due diligence by reducing property valuation cycles from days to seconds, unlocking faster approvals and improved borrower satisfaction.

- Automated Property Condition and Renovation Cost APIs help lenders assess collateral risk and repair needs upfront, minimizing unexpected expenses and ensuring accurate loan-to-value ratios.

- AI-driven Risk Scoring and Analytics APIs integrate environmental, title, and market data into a unified profile, enhancing portfolio quality and reducing default rates through proactive red-flag detection.

- Rental Income Projection APIs provide reliable, long- and short-term rental forecasts, empowering lenders to underwrite investment properties with data-backed confidence.

- Integrating these APIs end-to-end streamlines workflows, cuts operational costs by up to 60%, and delivers a competitive edge in the digital mortgage market by standardizing compliance, increasing capacity, and boosting profitability.

By integrating Homesage.ai’s APIs end-to-end, institutions can streamline workflows, cut operational costs by up to 60%, and secure a competitive edge in the digital mortgage market through standardized compliance, increased capacity, and improved profitability.

Conclusion

Real estate data APIs are reshaping due diligence, making weeks-long manual processes obsolete. The most successful lenders of 2025 treat APIs not as add‑ons but as the foundation of agile, automated decision‑making.

Faster deals build a reputation. More brilliant insights strengthen portfolios. Lower costs amplify returns. The compounding advantage of adopting these tools today lies in outpacing competitors tomorrow.

For lenders aiming to modernize operations, API integration is no longer a technology initiative; it’s a strategic imperative.

Platforms like Homesage.ai address all the pain points described above and enable the workflows lenders need in 2025 to stay competitive.

Frequently Asked Questions (FAQs)

Q: How do real estate data APIs improve lending accuracy?

A: They provide verified, up‑to‑date information from trusted sources, minimizing human error and supporting consistent, data‑driven underwriting decisions.

Q: What safeguards protect sensitive data in API workflows?

A: Modern APIs employ encryption, tokenization, and multi‑factor authentication, meeting strict data‑security and privacy standards.

Q: How long does API integration to lender platforms usually take?

A: Basic connections can be accomplished within hours or days using documented RESTful APIs and sandbox environments, with complete workflows added progressively.

Q: Can APIs connect to legacy systems?

A: Yes. Middleware and API management layers enable advanced data APIs to interact with legacy lending systems, seamlessly bridging modernization gaps.

2 Comments

Peter 10 hours ago

Very informative!

Wilson 8 hours ago

Thanks Homesage.ai for this blog.