A comprehensive Developer’s Guide to Real Estate Data has become essential for developers building sophisticated property technology applications in today’s competitive market.

Real estate data powers everything from property valuation tools to investment platforms, making it crucial for developers to understand the various real estate data types, sources, and implementation strategies available in 2025.

The real estate industry has transformed dramatically over the past few years, with artificial intelligence and machine learning technologies revolutionizing how property data is collected, analyzed, and utilized.

Modern developers need comprehensive knowledge of real estate data ecosystems to build applications that deliver accurate insights and exceptional user experiences.

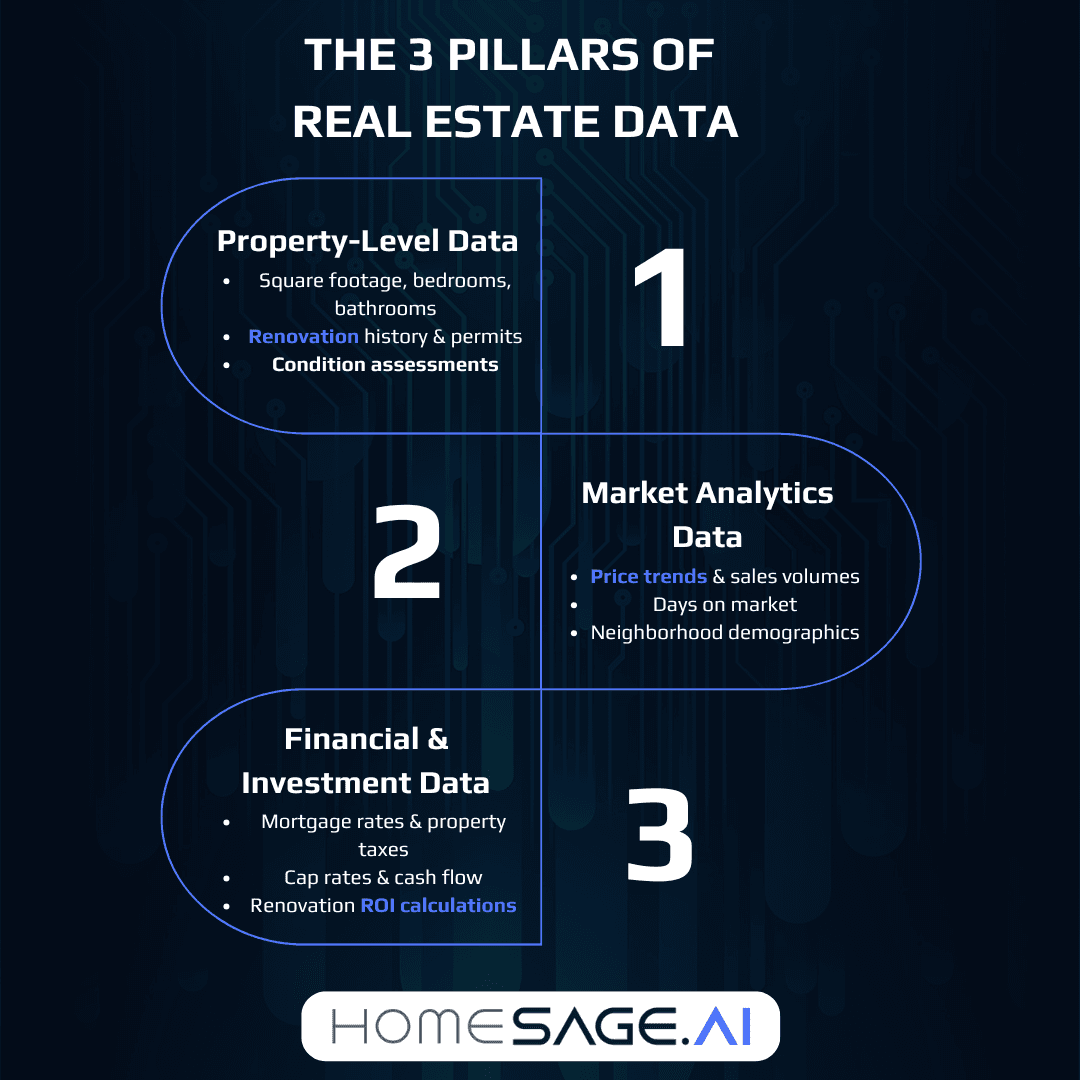

Understanding Real Estate Data Types

Property-Level Data

Property-level data forms the foundation of most real estate applications and includes detailed information about individual properties. This data encompasses basic characteristics like square footage, number of bedrooms and bathrooms, lot size, year built, and property type.

Advanced property data provided by companies like Homesage.ai also includes ROI calculations, Renovation Cost, Price Flexibility Score, Short (Airbnb) and long-term rental calculations, renovation history, permit records, zoning information, and structural details that impact valuation and investment potential.

Modern property data APIs provide access to comprehensive property profiles that can include everything from tax assessment records to utility connections.

This means developers can build applications that don’t just show users property listings, but actually help them understand whether a property is a smart investment, needs significant repairs, or offers room for price negotiation—all through simple API calls without building complex analysis algorithms from scratch.

Market Analytics Data

Market analytics data provides the broader context needed for property investment and valuation decisions. This category includes price trends, sales volumes, days on market, inventory levels, and market appreciation rates across different geographic areas.

Market data helps developers create applications that can identify emerging opportunities and assess market conditions.

Real-time market data has become increasingly important as property values fluctuate more rapidly than in previous decades. IT developers building investment-focused applications need access to current market metrics that reflect actual conditions rather than outdated historical averages. This includes median sales prices, price per square foot trends, and comparative market analysis data.

Neighborhood-level analytics extend market data to include demographic information, school ratings, crime statistics, walkability scores, and local amenities. This contextual information helps users understand the broader factors that influence property values and quality of life considerations.

Financial and Investment Data

Financial data encompasses the monetary aspects of real estate transactions and ownership, including mortgage rates, property taxes, insurance costs, and HOA fees.

For investment-focused applications, this category expands to include rental rates, cap rates, cash flow projections, and return on investment calculations.

Advanced financial data includes renovation cost estimates and potential return calculations that help investors evaluate improvement opportunities.

Homesage.ai‘s Renovation Cost API and Renovation Return API provide developers with tools to integrate detailed cost analysis and ROI projections directly into their applications, enabling users to make data-driven renovation decisions.

- Property Valuation Models: Automated Valuation Models (AVMs), comparative market analysis, and professional appraisal data

- Investment Metrics: Cash-on-cash returns, internal rate of return, gross rent multipliers, and debt service coverage ratios

- Market Performance: Historical value trends, appreciation rates, and volatility measurements

- Financing Information: Available loan products, interest rates, and qualification requirements

Real Estate Data Sources and APIs

Traditional Data Sources

Multiple Listing Services (MLS) have traditionally been the primary source of real estate data, providing comprehensive property listings and transaction records. However, MLS access typically requires real estate licensing and membership fees, making it challenging for many developers to obtain direct access.

Modern API providers often aggregate MLS data alongside other sources to provide more accessible alternatives.

Public records represent another fundamental data source, including property tax records, deed transfers, building permits, and court filings. These records provide official documentation of property ownership, legal status, and government-assessed values. While public records are typically available for free, accessing and standardizing this data across multiple jurisdictions can be technically challenging.

Commercial data providers like ATTOM Data and CoreLogic offer processed and standardized datasets that combine multiple sources into unified APIs. These providers handle the complexity of data aggregation and standardization, allowing developers to focus on application functionality rather than data management challenges.

Modern Real Estate API Platforms

Contemporary real estate API platforms provide sophisticated data services that go beyond simple property listings. These platforms combine multiple data sources with advanced analytics to deliver actionable insights through developer-friendly interfaces. Modern APIs typically offer RESTful endpoints with JSON responses, comprehensive documentation, and flexible query parameters.

Specialized API providers like Homesage.ai focus on specific use cases such as investment analysis and property condition assessment. These platforms provide targeted APIs like the Investment Potential API and Price Flexibility Score (PFS) API that deliver specific insights rather than raw data, enabling developers to integrate sophisticated analysis tools without building complex algorithms from scratch.

Real-time data capabilities have become increasingly important as market conditions change rapidly. Modern APIs provide webhook notifications, real-time updates, and event-driven data flows that keep applications current with market changes and new property listings.

Data Integration Strategies

API Selection and Architecture

Choosing the right combination of APIs requires careful consideration of data coverage, update frequency, pricing models, and technical requirements. Developers should evaluate APIs based on geographic coverage, data accuracy, response times, and documentation quality. Many applications benefit from combining multiple APIs to achieve comprehensive data coverage.

API architecture decisions significantly impact application performance and scalability. Developers should implement appropriate caching strategies, rate limiting, and error handling to ensure reliable data access. Asynchronous processing becomes essential when working with multiple data sources or performing complex calculations on large datasets.

Data standardization across different APIs presents ongoing challenges, as providers may use different formats, field names, and value representations. Implementing robust data transformation layers helps maintain consistency across different data sources and simplifies application logic.

Performance Optimization

Real estate applications often require processing large amounts of data to generate insights and comparisons. Effective caching strategies can significantly improve response times while reducing API costs and server load. Developers should implement intelligent caching that considers data freshness requirements and usage patterns.

- Database Design: Optimize schema design for common query patterns and implement appropriate indexing strategies

- Caching Layers: Implement Redis or similar solutions for frequently accessed data with appropriate TTL settings

- API Rate Management: Design request batching and throttling to stay within provider limits while maintaining responsiveness

- Background Processing: Use job queues for intensive calculations and data synchronization tasks

Query optimization becomes crucial when working with large property datasets. Implementing efficient search algorithms, geographic indexing, and result pagination helps maintain application performance as data volumes grow. Consider using specialized search engines like Elasticsearch for complex property search functionality.

Comparison Table: Leading Real Estate Data APIs

API Provider | Property Data | Market Analytics | Investment Metrics | Geographic Coverage | Pricing Model |

Homesage.ai | Comprehensive property details, condition assessments | Property-centered, price flexibility scores | ROI calculations, renovation returns, flip analysis | US-focused with detailed coverage | Subscription and Usage-based with flexible plans |

ATTOM Data | Extensive property characteristics | Historical trends, foreclosure data | Basic valuation models | Nationwide US coverage | Subscription and per-call options |

Property listings, Zestimate values | Market trends, rental estimates | Limited investment metrics | US residential focus | Invitation only |

Leveraging Real Estate Data for Development

Building Investment Analysis Tools

Investment-focused applications require sophisticated data analysis capabilities that combine property characteristics, market conditions, and financial projections. Developers can leverage APIs like Homesage.ai‘s Full Report API to access comprehensive property analysis that aggregates data from multiple sources into actionable investment insights.

Modern investment tools go beyond simple calculators to provide scenario analysis, risk assessment, and comparative evaluations. These applications help users understand not just current property values but potential future performance under different market conditions and improvement scenarios.

Machine learning integration allows applications to identify patterns in successful investments and provide personalized recommendations based on user preferences and historical performance data. This approach helps users discover opportunities they might otherwise overlook while avoiding common investment mistakes.

Creating Market Intelligence Platforms

Market intelligence platforms aggregate data across multiple properties and geographic areas to identify trends and opportunities. These applications require robust data processing capabilities and sophisticated visualization tools to help users understand complex market dynamics.

Real-time market monitoring capabilities enable users to receive alerts about significant market changes, new listings matching their criteria, or properties that meet specific investment parameters. This proactive approach helps users respond quickly to market opportunities and changes.

Geographic information systems (GIS) integration allows applications to provide location-based analysis that considers factors like proximity to amenities, transportation access, and neighborhood development plans. This spatial analysis adds crucial context to property valuations and investment decisions.

Implementation Best Practices

Data Security and Privacy

Real estate data often includes sensitive information about property owners, transaction details, and personal circumstances. Developers must implement appropriate security measures to protect user data and comply with privacy regulations like GDPR and CCPA.

This includes encryption for data transmission and storage, secure authentication mechanisms, and appropriate access controls.

API key management becomes crucial when working with multiple data providers, as compromised credentials could result in unauthorized access or unexpected charges. Implement secure key storage, rotation policies, and monitoring to detect unusual usage patterns.

Data retention policies should align with business requirements and regulatory obligations, automatically purging unnecessary data while maintaining essential records for legitimate business purposes. Consider implementing data anonymization techniques for analytics and testing environments.

Scalability Considerations

Real estate applications often experience significant traffic variations based on market conditions, time of year, and user behavior patterns. Design applications with scalable architecture that can handle peak loads without compromising performance or reliability.

Database scaling strategies should consider both read and write operations, implementing appropriate sharding, replication, and caching mechanisms. Real estate data queries often involve complex geographic and numerical filtering that benefits from specialized indexing approaches.

Microservices architecture can help isolate different data processing functions, allowing independent scaling of components based on usage patterns. This approach also facilitates integration with multiple API providers and enables more efficient resource utilization.

Future Trends in Real Estate Data

The integration of artificial intelligence and machine learning continues to expand the possibilities for real estate data analysis. Smart technology and AI integration are becoming essential for maximizing property value, with predictive analytics helping investors identify opportunities before they become obvious to the broader market.

Blockchain technology promises to improve data accuracy and reduce fraud by creating immutable records of property transactions and ownership changes. This technology could significantly impact how property data is verified and shared across different platforms and stakeholders.

Generative AI represents a transformative opportunity for real estate, enabling more sophisticated analysis of market trends, automated report generation, and personalized investment recommendations that consider individual user preferences and risk profiles.

Real estate predictions emphasize the growing importance of advanced data management solutions and the need for real estate companies to adapt their technology infrastructure to handle increasingly complex data requirements while meeting evolving regulatory and customer expectations.

Key Takeaways

A guide to Real Estate Data implementation requires understanding multiple data categories including property characteristics, market analytics, and financial metrics. Successful applications typically integrate multiple data sources through well-designed APIs that provide comprehensive coverage while maintaining performance and reliability.

For a deeper look into how to generate a full property report using a real estate data API, watch this video.

Modern real estate API platforms offer sophisticated analysis capabilities that go beyond simple data access, providing processed insights and calculated metrics that would be difficult to generate independently. Platforms like Homesage.ai demonstrate how specialized APIs can provide targeted functionality for specific use cases like investment analysis and property condition assessment.

Data security, scalability, and performance optimization remain critical considerations for real estate applications, requiring careful architecture decisions and ongoing monitoring to ensure reliable operation as data volumes and user bases grow.

The future of real estate data continues to evolve with artificial intelligence, blockchain, and IoT technologies creating new opportunities for more accurate analysis and better user experiences. Developers who understand these trends and implement flexible architectures will be better positioned to adapt to ongoing changes in the real estate data landscape.

Conclusion

This guide to Real Estate Data mastery represents a fundamental requirement for developers building modern property technology applications. The combination of comprehensive property data, sophisticated analytics, and user-friendly implementation creates opportunities for innovative applications that serve investors, agents, and property professionals more effectively than traditional tools.

Success in real estate application development requires understanding both the technical aspects of data integration and the business requirements of real estate professionals. By leveraging modern API platforms and implementing appropriate scalability and security measures, developers can create applications that provide genuine value to users while building sustainable businesses.

The continued evolution of real estate data sources and analysis techniques ensures that this field will remain dynamic and full of opportunities for developers who stay current with emerging trends and technologies. Building expertise in real estate data now positions developers to take advantage of the significant growth expected in property technology over the coming years.

People Also Ask

Q: What types of data are most important for real estate investment applications?

A: Real estate investment applications benefit most from comprehensive property data (characteristics, condition, history), market analytics (price trends, sales volume, days on market), and financial metrics (rental rates, cap rates, ROI projections).

Investment-focused platforms should also include renovation costs, potential returns, and comparative analysis tools. APIs like Homesage.ai‘s Investment Potential and Flip Return APIs provide pre-calculated investment metrics that simplify application development while delivering professional-grade analysis capabilities.

Q: How do developers ensure real estate data accuracy and reliability?

A: Data accuracy requires using reputable API providers that aggregate multiple sources and implement quality control measures. Developers should validate data through cross-referencing multiple sources, implement error checking and data sanitization processes, and establish monitoring systems to detect anomalies.

Working with established providers like ATTOM Data, CoreLogic, or specialized platforms like Homesage.ai helps ensure data quality through their professional data management practices and regular updates from authoritative sources.

Q: What are the main challenges in integrating multiple real estate data APIs?

A: The primary challenges include data standardization across different formats and schemas, managing rate limits and costs from multiple providers, handling different update frequencies and data freshness requirements, and maintaining application performance with multiple external dependencies.

Successful integration requires implementing robust data transformation layers, efficient caching strategies, and proper error handling. Developers should also plan for API versioning changes and potential service disruptions through appropriate fallback mechanisms.

1 Comment

N 14 hours ago

That's a very insightful breakdown.