Introduction

Artificial intelligence has moved from buzzword to business backbone—and real estate investing is feeling the shift in a big way.

AI equips investors with faster deal discovery, sharper underwriting, and more confident decision-making by analyzing massive datasets that humans simply can’t process in time.

In short, yes—AI can help a real estate investor become better, faster, and more profitable by augmenting analysis, reducing risk, and streamlining workflows from sourcing to exit.

When used well, AI doesn’t replace investor judgment—it amplifies it with speed, context, and pattern recognition that unlocks better opportunities and outcomes.

Why AI Matters Now in Real Estate Investing

AI’s biggest value for investors is its ability to connect disparate signals—market trends, property conditions, pricing sentiment, rental comps, renovation costs, climate risk, and local economics—into coherent decisions at scale.

As competition intensifies and margins tighten, this edge compounds, allowing investors to move first on high-quality deals and pass on hidden liabilities before they become costly mistakes.

Industry leaders note accelerating adoption of AI for valuation, underwriting, and risk modeling, with data-intensive workflows seeing the most immediate benefits.

For investors, that translates to better sourcing, due diligence, and execution—and ultimately, better portfolio performance.

The Core Ways AI Improves Real Estate Investing

- Deal sourcing and screening: AI scans on- and off-market inventory, scoring properties by investment potential and surfacing hidden opportunities that match specific return profiles.

- Property valuation and forecasting: Machine learning blends traditional valuation inputs with real-time market data to increase accuracy and anticipate value shifts earlier.

- Rental and cash-flow modeling: AI estimates short-term and long-term rental income, NOI, cap rates, IRR, and cash-on-cash faster and across more candidates than manual analysis allows.

- Renovation scope and ROI: Computer vision and cost models help estimate renovation needs, budgets, and profit potential with improved precision.

- Risk detection: Advanced analytics flag factors such as climate exposure, demand volatility, or neighborhood dynamics that could threaten cash-flow stability.

Homesage.ai operationalizes many of these advantages through products like Investment Property Search, Full Property Reports, and granular APIs for investment potential, property condition, renovation return, and rental projections.

How Homesage.ai Helps Investors Become Better

Homesage.ai caters to investors by turning raw listing and off-market data into concise, decision-ready insights.

It automates discovery, due diligence, and modeling to streamline the path from lead to LOI. Notable capabilities include:

- Investment Potential and Price Flexibility Score: Identify negotiability and upside so offers align with actual value gaps.

- Property Condition via computer vision: Rapidly assess property health to calibrate scope and risk.

- Renovation Cost and ROI: Budget accurately and forecast post-renovation value and profit.

- Long- and Short-term Rental Estimates: Project revenue, NOI, IRR, cap rate, and cash-on-cash to compare strategies.

- Full Property Reports: Consolidate key metrics into a single, fast, shareable report for any U.S. property.

For example, workflows and pricing by API endpoint, see Homesage.ai’s product catalog, which outlines costs per credit and available responses for each insight type.

AI for Real Estate Investing: Strengths and Limitations

AI thrives on large, fresh datasets—transaction histories, listing photos, rent rolls, macro signals—and can process these far faster than manual workflows, making it ideal for triaging, ranking, and quantifying decisions.

However, investors should still validate model outputs, pressure-test assumptions, and account for qualitative factors such as local zoning nuances, permitting timelines, neighborhood sentiment, and boots-on-the-ground observations.

The winning approach blends AI-driven speed with human judgment and field intelligence.

What AI Improves Right Away

- Faster deal flow: Automated scanning of MLS and off-market sources yields a bigger top of funnel and better fit to the buy box.

- Better underwriting: Instant, standardized modeling reduces errors and accelerates decision cycles.

- Reduced renovation risk: Computer vision and cost models temper optimism bias and help right-size budgets.

- Clearer negotiation strategy: Pricing sentiment and flexibility signals guide offer structure and timing.

- Portfolio resilience: Forecasting and risk analytics improve exposure management across markets and property types.

Homesage.ai aligns to the AI-enhanced column through its Investment Property Search, Full Property Reports, and specialized APIs that bundle investment potential, condition, renovation metrics, and rental performance into a standardized workflow.

Building an AI-First Investor Workflow

Adopting AI doesn’t require rebuilding an entire operation overnight, but it helps to sequence improvements where impact is highest.

- Start with sourcing: Use AI platforms that scan broad inventory and score opportunities to expand deal flow without more headcount.

- Standardize underwriting: Define consistent inputs and outputs (e.g., cap rate, cash-on-cash, IRR) and let models generate them automatically across candidates.

- Add renovation and pricing signals: Integrate condition scoring, renovation ROI, and pricing flexibility to refine offers and reduce post-acquisition surprises.

- Layer in rental strategy: Model both long-term and short-term rental performance to compare cash-flow paths and exit options.

- Institutionalize risk analysis: Incorporate climate, demand, and location risk signals into hold/sell decisions and portfolio construction.

Homesage.ai supports this roadmap by offering plug-and-play APIs and reports so teams can automate parts of the process without tearing up existing systems.

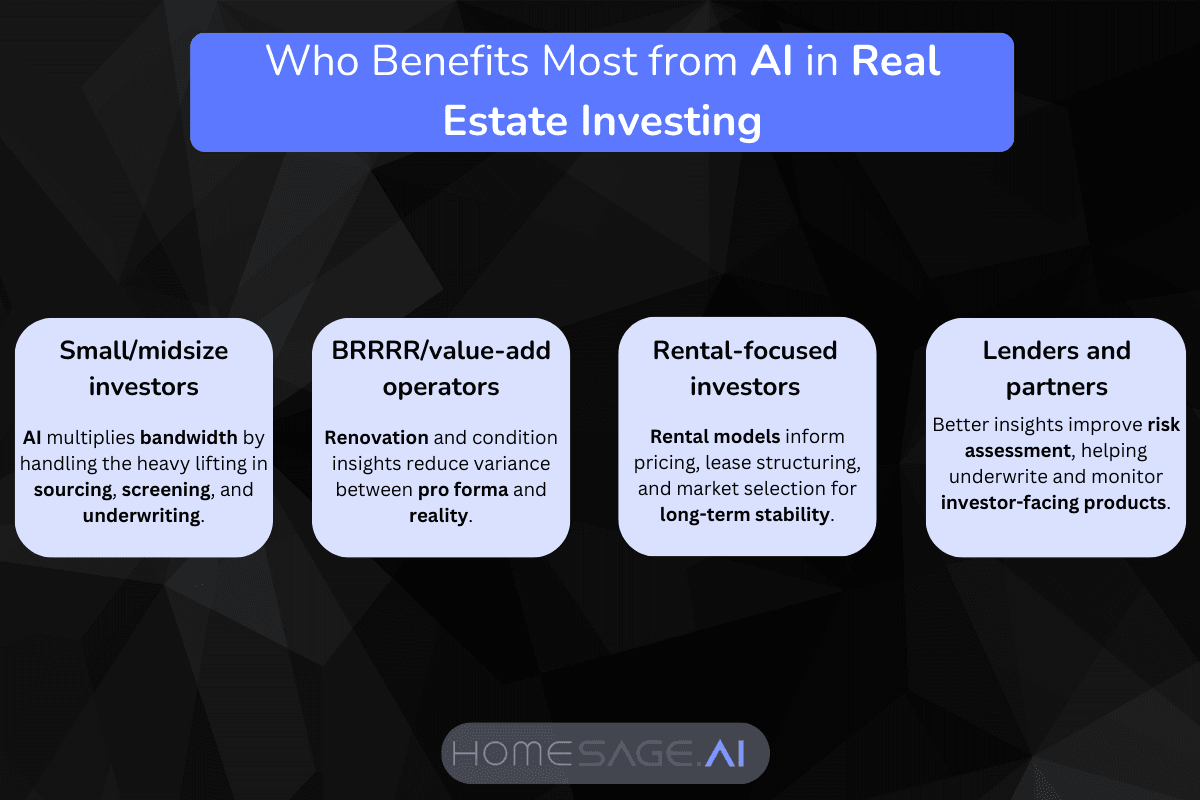

For Whom AI Delivers the Biggest Gains

- Small and midsize investors scaling up: AI multiplies bandwidth by handling the heavy lifting in sourcing, screening, and underwriting.

- BRRRR and value-add operators: Renovation and condition insights reduce variance between pro forma and reality.

- Rental-focused investors: Rental models inform pricing, lease structuring, and market selection for long-term stability.

- Lenders and partners: Better insights improve risk assessment, helping underwrite and monitor investor-facing products.

Where AI Is Headed Next in Real Estate Investing

Expect tighter integration between property intelligence, climate analytics, and financing, with underwriting that dynamically adapts to shifting risk and demand.

As models ingest richer signals—from satellite and IoT data to localized economic micro-trends—the speed-accuracy frontier will move again, further compressing time-to-decision and raising the bar for manual-only approaches. Investors who combine AI with disciplined, on-the-ground validation will likely outperform the market over time.

From Insight to Execution: Operationalizing AI for Real-World Returns

To translate AI insights into reliable alpha, investors need a simple operating rhythm that turns data into action and learning into continuous improvement.

Operational cadence that compounds results

Weekly:

- Refresh deal lists and alerts filtered by your buy box and Price Flexibility signals.

- Run standardized underwriting (cash flow, cap rate, IRR, DSCR) on top candidates.

- Trigger quick-hit diligence: photo review, condition scoring, renovation budget sanity check, rent comps verification.

Monthly:

- Review funnel conversion: leads → underwritten → offers → accepted → closed. Diagnose stalls and tune score thresholds.

- Compare projected vs. realized rents on recent acquisitions; recalibrate rent growth and vacancy assumptions if variance > ±5%.

- Reassess market exposure (A/B/C tiers, climate risk, employer concentration) and rebalance targets if risk drifts.

Quarterly:

- Backtest models against closed deals from the past 12 months; check whether investment potential and pricing signals correlated with realized IRR and cash-on-cash.

- Update buy box constraints based on macro shifts (rates, insurance costs, new supply).

- Audit renovation variance—scope creep, permitting delays, budget overages—and adjust renovation ROI thresholds.

Key metrics to track for AI-driven portfolios

- Sourcing efficiency: Qualified leads per week, percent meeting score thresholds, time-to-underwrite per property.

- Offer precision: Win rate at or below target basis, average delta vs. AVM value, leverage retained via credits/terms.

- Underwriting accuracy: Variance between projected and realized NOI, rent, vacancy, and OpEx.

- Renovation performance: Budget variance, timeline variance, uplift vs. forecast.

- Portfolio resilience: DSCR distribution, interest rate and insurance sensitivity, market concentration.

- Cycle time: Days from discovery to LOI to close—often the biggest competitive edge AI unlocks.

Two quick scenarios:

- BRRRR team scaling responsibly: A small team screens 500 properties weekly with AI, underwrites 20 in a day, walks 5, bids 3. Computer vision flags hidden exterior wear and moisture risk on two; budgets are adjusted pre-offer, protecting returns. Post-close, realized rents land within 3% of projections and renovations finish early due to right-sized scope.

- STR-to-LTR pivot: A coastal investor models both STR and LTR outcomes. AI highlights strong seasonal ADR but elevated regulatory and insurance risk. They buy on LTR underwriting with STR as optionality. Six months later, new STR caps validate the conservative base case—cash flow stays on plan.

How Homesage.ai fits into daily execution

- Morning triage: Pull Investment Property Lists filtered by your buy box; sort by Investment Potential and Price Flexibility to pick underwriting targets.

- Diligence burst: Use Full Property Reports for condition signals, renovation cost/ROI, and rental projections; share a one-pager for partner review.

- Offer shaping: Use renovation ROI and rental estimates to set walk-away pricing and concessions; track pass/fail patterns to refine thresholds.

- Portfolio review: Compare realized performance vs. projections and feed learnings back into score sensitivity.

Risks to respect—even with AI

- Local nuance: Zoning quirks, permitting backlogs, HOA rules, parking ratios, septic vs. sewer—each can break a pro forma. Always run a boots-on-the-ground checklist before going hard.

- Insurance and climate: Premium shocks and deductibles can erase NOI gains; ensure models reflect current carrier trends and hazard maps.

- Data blind spots: Sparse comps or unique assets (rural, unusual builds) warrant wider error bands and more conservative offers.

- Behavioral traps: Don’t chase only high-scoring deals—review passes that later performed well to prevent overfitting your filters.

Negotiation frameworks powered by AI signals

- Anchor with flexibility data: If Price Flexibility and time-on-market suggest softness, anchor with room for inspection credits while protecting basis.

- Scope-to-credit trade: When condition models surface issues, seek seller credits to offset scope rather than pure price cuts to preserve appraisal value.

- Terms over price: In tight bids, cleaner terms (shorter contingencies, flexible close) can win when your AI-backed diligence gives confidence—without sacrificing key protections.

Team enablement and culture:

- Centralize: Keep each property’s AI report, underwriting memo, and decision in one system of record.

- Define SLAs: Speed is compounding—set standards for triage and underwriting turnaround.

- Post-mortems: For misses or underperformers, identify which assumption failed and adjust thresholds or training data.

- Train: New analysts learn faster by comparing field outcomes with model projections.

Capital and lender conversations

AI-standardized underwriting (rent comps, DSCR forecasts, condition and renovation detail) improves lender confidence and can tighten approval timelines. Maintain a realized-vs-projected dashboard—your credibility engine for better terms.

How Homesage.ai Fits Into an Investor’s Stack

Homesage.ai functions as a decision engine that reduces friction across sourcing, underwriting, and negotiation while supporting API-based integration into existing tools. It covers the full U.S. residential market, scoring investment potential, condition, renovation return, rental performance, and pricing flexibility, with instant Full Property Reports for sharing and internal approvals. Lenders also leverage these insights to streamline valuations and minimize risk exposure when backing investor deals.

Explore Homesage.ai to see how AI-powered lists, reports, and APIs can accelerate investment workflows across the U.S. housing market.

Conclusion

AI has become a force multiplier for real estate investing by expanding deal flow, standardizing underwriting, and adding predictive clarity around value, rent, renovation, and risk—at speed and scale that were previously unattainable.

The best outcomes come from a hybrid approach: let AI do the heavy data lifting and pattern recognition, then apply human judgment, local knowledge, and disciplined execution to close the loop.

Homesage.ai exemplifies how investors can operationalize this advantage today through investment scoring, condition analysis, renovation ROI, rental forecasting, and negotiation signals across the entire U.S. residential market—turning information overload into profitable action.

People Also Ask

Q1: How exactly does AI help real estate investors find better deals?

A: AI scans on- and off-market inventory at scale, ranks properties by investment potential, flags pricing flexibility, and triggers alerts so investors can act quickly on high-ROI opportunities.

Q2: Can AI make real estate valuations more accurate?

A: Yes, AI blends traditional comps with real-time market data to produce more reliable valuations and can even forecast future value changes earlier than manual methods.

Q3: Is AI useful for underwriting rentals and renovation projects?

A: AI estimates short- and long-term rental income, NOI, cap rates, and IRR, while computer vision and cost models size renovation budgets and ROI—helping investors avoid overpaying or overbuilding.