Introduction

The real estate investment landscape is undergoing a revolutionary transformation, driven by artificial intelligence (AI) technologies that are reshaping how investors analyze markets, evaluate properties, and make strategic decisions.

As traditional investment methods give way to data-driven approaches, AI in real estate investment has emerged as a game-changing force that enables investors to process vast amounts of market data, identify profitable opportunities, and minimize risks with unprecedented accuracy.

Integrating AI in real estate investment is no longer a futuristic concept—it’s a present-day reality that successful investors are leveraging to gain competitive advantages.

From predictive analytics that forecast market trends to automated valuation models that assess property worth in real-time, AI tools are democratizing access to sophisticated investment insights that were once available only to institutional investors with massive resources.

This comprehensive guide explores three essential best practices for effectively integrating AI into your real estate investment strategy.

Whether you’re a seasoned investor looking to modernize your approach or a newcomer seeking to leverage cutting-edge technology from the start, these practices will help you harness the power of AI to make more informed decisions, optimize your portfolio performance, and achieve superior returns in today’s dynamic real estate market.

Best Practice #1: Leverage Comprehensive Property Data Analysis Platforms

The foundation of successful AI integration in real estate investment begins with utilizing comprehensive property data analysis platforms that can process and interpret massive datasets to provide actionable insights.

Modern AI-powered platforms have revolutionized how investors access, analyze, and act upon property information, transforming raw data into strategic intelligence.

Homesage.ai represents a prime example of how artificial intelligence can enhance real estate investment decision-making through advanced property analysis capabilities.

These sophisticated platforms utilize machine learning algorithms to analyze historical sales data, market trends, neighborhood demographics, and property characteristics to generate comprehensive investment recommendations.

By processing thousands of data points simultaneously, AI platforms can identify patterns and correlations that would be impossible for human analysts to detect manually.

The key advantages of implementing comprehensive data analysis platforms include:

- Real-time market intelligence: AI systems continuously monitor market conditions, price fluctuations, and emerging trends to provide up-to-the-minute insights that inform investment timing decisions.

- Predictive modeling capabilities: Advanced algorithms forecast future property values, rental yields, and market demand based on historical patterns and current market indicators.

- Risk assessment automation: AI evaluates multiple risk factors, including market volatility, neighborhood crime statistics, and economic indicators, to provide comprehensive risk profiles for potential investments.

- Comparative market analysis: Automated systems generate detailed comparable property analyses, helping investors understand fair market values and identify undervalued opportunities.

When implementing comprehensive data analysis platforms, investors should focus on solutions that offer API integration capabilities, allowing seamless data flow between different tools and systems.

This integration ensures that investment decisions are based on the most current and comprehensive information available, reducing the likelihood of costly mistakes and missed opportunities.

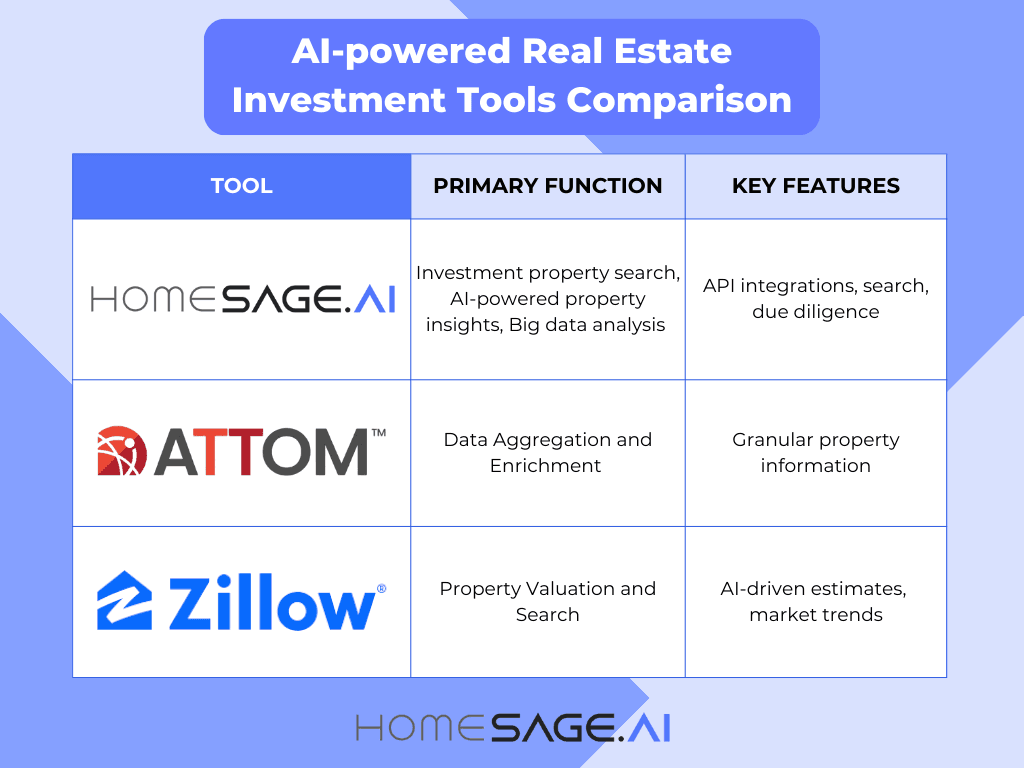

Table 1: AI-powered Real Estate Investment Tools Comparison

Tool | Primary Function | Key Features | Best For | Pricing Model |

Investment property search, AI-powered property insights, Big data analysis | API integrations, search, due diligence | Investment property search, Due diligence, API integration | Subscription-based, tiered plans | |

Data Aggregation and Enrichment | Granular property information | Due diligence and risk assessment | Pay-per-use or enterprise licenses | |

Property Valuation and Search | AI-driven estimates, market trends | Quick valuations and buyer insights | Free basic access, premium add-ons |

Best Practice #2: Implement Advanced Market Trend Analysis and Forecasting

The second critical best practice involves implementing advanced market trend analysis and forecasting capabilities that leverage AI’s predictive power to anticipate market movements and identify emerging investment opportunities.

This approach goes beyond simple historical data review to employ sophisticated algorithms that can process economic indicators, demographic shifts, and market sentiment to forecast future conditions.

Attom Data exemplifies the power of advanced market analytics in real estate investment. Their AI-driven platform processes millions of property records, sales transactions, and market indicators to provide investors with detailed market forecasts and trend analyses.

This level of sophisticated data processing enables investors to make proactive decisions rather than reactive ones, positioning themselves ahead of market movements rather than following them.

Effective market trend analysis through AI involves several key components:

- Macro-Economic Integration: AI systems analyze broader economic indicators such as interest rates, employment levels, GDP growth, and inflation rates to understand their impact on local real estate markets. This macro-level analysis helps investors understand how national and global economic trends will affect their local investment opportunities.

- Demographic Analysis: Advanced AI platforms examine population growth patterns, age demographics, income levels, and migration trends to predict future housing demand in specific markets. This demographic intelligence is crucial for long-term investment success, as it helps investors identify markets with sustainable growth potential.

- Supply and Demand Modeling: AI algorithms analyze construction permits, new development projects, and housing inventory levels to forecast supply-demand imbalances that create investment opportunities. This analysis helps investors identify markets where supply constraints may drive future price appreciation.

Best Practice #3: Utilize AI-Powered Property Valuation

The third essential best practice focuses on implementing AI-powered property valuation that provides objective, data-driven assessments of individual properties.

The third essential best practice focuses on implementing AI-powered property valuation that provides objective, data-driven assessments of individual properties.

This approach eliminates much of the guesswork and emotional decision-making that can lead to poor pricing or investment choices, replacing subjective judgments with quantitative analysis based on comprehensive data sets.

Zillow has pioneered the use of AI in property valuation through its Automated Valuation Model (AVM), which processes hundreds of property characteristics, recent sales data, and market trends to generate estimated property values.

While Zillow’s model is designed for general market use, similar AI-powered valuation systems, like homesage.ai, can be customized for investment-specific criteria, incorporating factors such as rental yield potential, renovation costs, and long-term appreciation prospects.

Modern AI valuation systems offer several sophisticated capabilities:

- Multi-Factor Analysis: AI algorithms simultaneously evaluate dozens of property characteristics including location, size, condition, amenities, and neighborhood features to generate comprehensive property scores. This multi-dimensional analysis provides a more accurate and complete picture of property value than traditional methods.

- Dynamic Pricing Models: AI systems continuously update property valuations based on new market data, ensuring that investment decisions are based on current rather than outdated information. This dynamic approach is particularly valuable in rapidly changing markets where property values can shift quickly.

- Investment-Specific Metrics: Advanced AI platforms calculate investment-specific metrics such as cap rates, cash-on-cash returns, and internal rates of return based on current market conditions and projected future performance. These calculations help investors compare different opportunities objectively.

- Risk-Adjusted Scoring: AI systems incorporate risk factors into property scoring, adjusting potential returns based on market volatility, property-specific risks, and broader economic uncertainties. This risk-adjusted approach helps investors build more balanced and resilient portfolios.

Table 2: Implementation Timeline for AI Integration

Phase | Duration | Key Activities | Expected Outcomes |

Assessment & Planning | 2-4 weeks | Evaluate current processes, identify AI opportunities, and select tools | Clear integration roadmap |

Tool Selection & Setup | 4-6 weeks | Research platforms, configure systems, establish data connections | Operational AI tools |

Training & Testing | 6-8 weeks | Learn system capabilities, validate accuracy, refine processes | Competent AI utilization |

Full Implementation | 8-12 weeks | Deploy across all investment activities, optimize workflows | Transformed investment process |

Key Takeaways

- The successful integration of AI in real estate investment requires a strategic approach that combines comprehensive data analysis, advanced market forecasting, and intelligent property valuation.

- These three best practices provide a framework for leveraging artificial intelligence to enhance investment decision-making, reduce risks, and identify profitable opportunities that might otherwise be overlooked.

- Investors who embrace AI technologies position themselves to capitalize on the increasing availability of real estate data and the growing sophistication of analytical tools.

- By implementing these best practices systematically, real estate investors can build more efficient, profitable, and resilient investment strategies that adapt to changing market conditions and capitalize on emerging opportunities.

- The future of real estate investment belongs to those who can effectively combine human expertise with artificial intelligence capabilities. As AI technologies continue to evolve and become more accessible, investors who master these tools today will have significant advantages in tomorrow’s increasingly competitive real estate market.

Conclusion

The integration of AI in real estate investment represents a fundamental shift in how investors approach market analysis, property evaluation, and portfolio management.

The integration of AI in real estate investment represents a fundamental shift in how investors approach market analysis, property evaluation, and portfolio management.

The three best practices outlined in this guide—leveraging comprehensive data analysis platforms, implementing advanced market forecasting, and utilizing AI-powered valuation systems—provide a roadmap for successfully incorporating artificial intelligence into real estate investment strategies.

As AI-powered real estate tools like homesage.ai evolve, investors who embrace these AI-driven approaches will be better positioned to identify opportunities, manage risks, and achieve superior returns.

The key to success lies not just in adopting AI tools, but in understanding how to integrate them effectively into existing investment processes while maintaining the human judgment and market knowledge that remain essential to successful real estate investing.

People Also Ask

Q: How accurate is AI in predicting real estate market trends?

A: AI accuracy in predicting real estate market trends varies but typically ranges from 70-85% for short-term predictions (3-6 months) and 60-75% for longer-term forecasts (1-2 years).

The accuracy depends on data quality, market volatility, and the sophistication of the AI algorithms used. AI systems excel at identifying patterns in large datasets but may struggle with unprecedented market events or extreme volatility.

Q: What are the costs associated with implementing AI tools for real estate investment?

A: Costs for AI real estate investment tools range from $50-500 per month for platforms like homesage.ai to $1,000-10,000+ monthly for enterprise-level solutions like Attom Data.

Initial setup costs may include data integration fees ($500-3,000), training expenses ($500-2,000), and consultation fees ($2,000-10,000). However, these costs are often offset by improved investment returns and reduced analysis time.

Q: Can AI replace human expertise in real estate investment decisions?

A: AI cannot completely replace human expertise in real estate investment, but serves as a powerful complement to human judgment. While AI excels at data processing, pattern recognition, and objective analysis, human expertise remains crucial for understanding local market nuances, negotiating deals, managing relationships, and making strategic decisions that require contextual understanding and creative problem-solving.