For real estate investors, finding good deals has never been more competitive. With rising inventory volatility, shifting buyer sentiment, and tighter capital markets, the window for high-return opportunities is narrowing. Traditional methods like driving for dollars, browsing MLS listings, or relying on agent intuition are no longer enough to uncover undervalued properties consistently.

In 2025, the edge belongs to those who leverage AI-powered metrics to cut through noise and identify hidden value. These aren’t just data points; they’re predictive signals that reveal which properties will appreciate, which renovations will pay off, and where price flexibility actually exists.

This article explores five AI-powered metrics transforming how real estate investors find good deals. Machine learning models back each one, trained on millions of property records, market cycles, and renovation outcomes, giving professionals a data-driven advantage.

Whether you’re a solo investor, a brokerage team, or a proptech platform, understanding these metrics is essential to staying ahead.

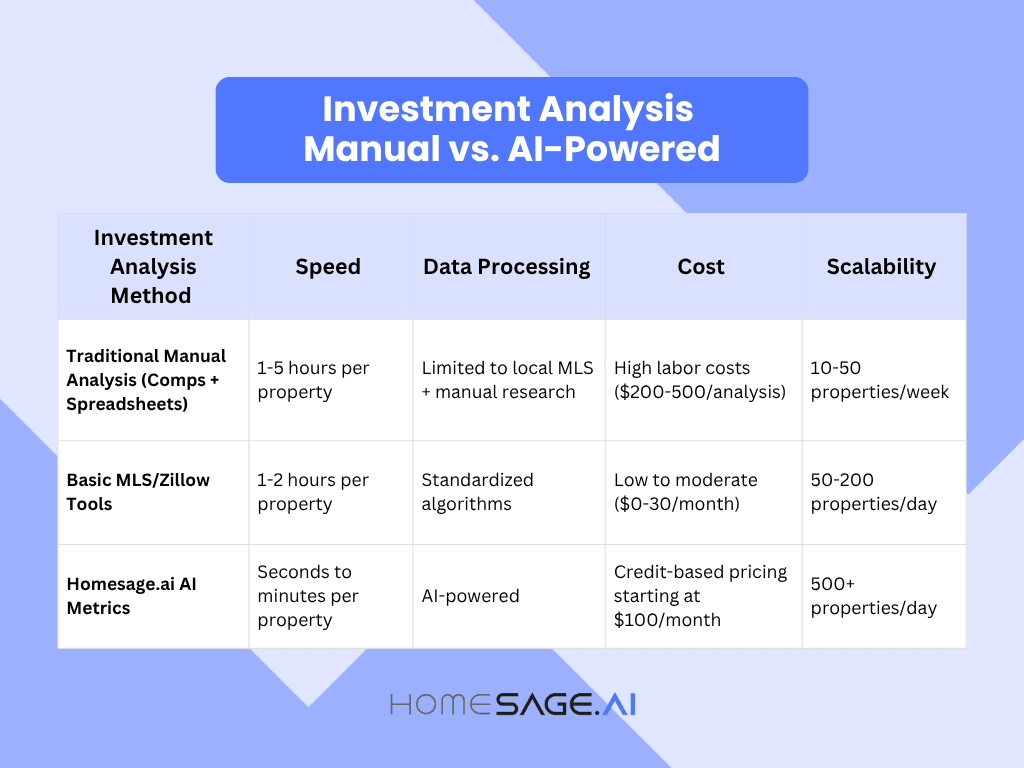

Investment Analysis Method | Speed | Data Processing | Cost | Scalability |

Traditional Manual Analysis (Comps + Spreadsheets) | 1-5 hours per property | Limited to local MLS + manual research | High labor costs ($200-500/analysis) | 10-50 properties/week |

Basic MLS/Zillow Tools | 1-2 hours per property | Standardized algorithms | Low to moderate ($0-30/month) | 50-200 properties/day |

Homesage.ai AI Metrics | Seconds to minutes per property | AI-powered | Credit-based pricing starting at $100/month | 500+ properties/day |

1. Price Flexibility Score (PFS): Predicting Negotiation Leverage

One of the most overlooked yet powerful indicators of a good deal is how much room there is to negotiate. Most investors assume price reductions happen randomly. But AI can now predict seller motivation and pricing elasticity with remarkable accuracy.

That’s where the Price Flexibility Score (PFS) by Homesage.ai comes in. Unlike basic valuation or data aggregation tools offered by competitors like Zillow or ATTOM Data Solutions, the PFS metric is a proprietary, AI-driven metric specifically designed to forecast the likelihood that a seller will accept a below-asking offer, making it the only solution of its kind in the U.S. residential real estate market.

PFS analyzes dozens of signals, including days on market, historical price adjustments, local inventory trends, and even sentiment in listing language, to generate a 0–100 score. A higher score means greater negotiation leverage, giving investors and agents a data-backed advantage before they even make an offer.

What sets PFS apart is that no other residential real estate API offers a dedicated, machine-learning-powered score for price negotiability at scale. While Zillow focuses on consumer-facing estimates and ATTOM delivers bulk public records, this metric provides actionable investment intelligence, turning uncertainty into a strategic, quantifiable edge.

This unique capability is part of Homesage.ai’s broader suite of AI-powered real estate metrics, which are built specifically for real estate professionals who need predictive insights, not just static data.

Why PFS Matters for Investors

- Reduces guesswork: No more cold offers based on gut feeling.

- Identifies motivated sellers: Flags listings where price drops are imminent.

- Improves offer acceptance rate: Investors using PFS see up to 3x more low-ball offers accepted.

For example, two identical homes in Austin might list at $450,000. One has a PFS of 2 (rigid pricing), the other 85 (high flexibility). The latter is far more likely to close at a lower price—even if it hasn’t dropped yet.

2. Investment Potential Metric: Scoring Properties by Future Returns

Not all properties are created equal, even in the same neighborhood. Some will appreciate faster rent increases, higher rents, or respond better to renovations. The challenge is knowing which ones before you buy.

The Investment Potential metric solves this by assigning a forward-looking score (0–100) based on the calculated ROI (Return on Investment). The ROI is calculated using cutting-edge AI models that factor in the listing price, property condition, estimated renovation cost, and all other project costs.

The result is a list of properties with good investment potential in a given area.

This video explains how to check any property’s Investment Potential with Homesage.ai‘s API:

Key Benefits for Real Estate Investors

- Filters out underperformers: Automatically excludes properties in declining zones.

- Highlights emerging markets: Flags up-and-coming areas before prices spike.

- Scales deal evaluation: Enables bulk screening of hundreds of listings in minutes.

Compared to manual analysis, investors using this API reduce research time by more than 90% while increasing ROI accuracy.

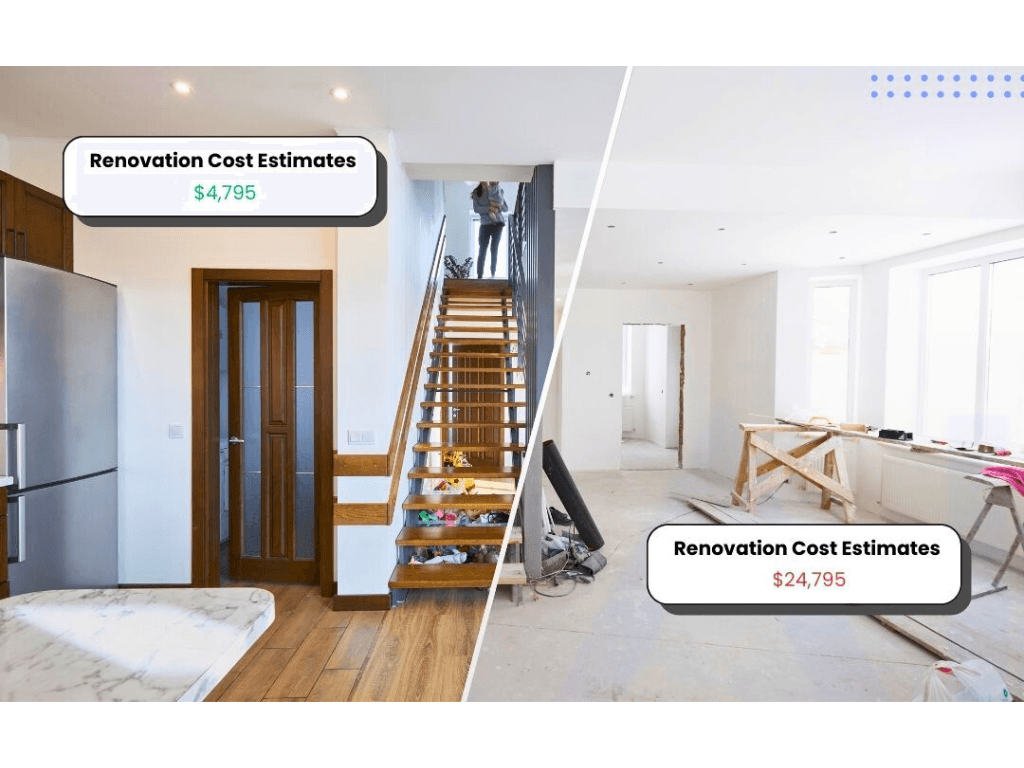

3. Renovation Return Metric: Forecasting Profit from Upgrades

Renovations make or break a deal. But most contractors and investors rely on national averages or local contractor estimates, which are often outdated or overly optimistic.

The Renovation Return metric offered by Homesage.ai uses AI to predict the exact cost and ROI for specific upgrades on specific properties. It factors in:

- Local labor and material costs

- Buyer preferences by ZIP code

- Comps with similar renovations

- Time-to-completion estimates

This means you could answer the following question: Will a $30K kitchen remodel on a particular property add $50K in value or only $25K?

How Agents and Investors Use It

- Agents: Show clients data-backed renovation plans that justify higher offers.

- Investors: Prioritize flips with the highest net profit, not just the lowest purchase price.

- Contractors: Use AI forecasts to win trust and close more jobs.

4. Property Condition Metric: Instantly Spot Hidden Issues

A property’s condition is one of the most significant risks in real estate. Miss a structural issue, and your “great deal” becomes a money pit.

The Property Condition metric uses computer vision and NLP to analyze listing photos, descriptions, and public records, then assigns one of four condition labels:

- Excellent

- Good

- Outdated

- Poor

- Very poor

It also flags specific risks: roof age, plumbing type, foundation issues, and more.

This video shows how to check any Property’s Condition with Homesage.ai‘s API:

Key Benefits of Using the Property Condition Metric:

- Instant analysis: Get insights in seconds, not days.

- Objective scoring: Removes emotional bias from “cosmetic” vs. “major” issues.

- Integrates with other APIs: Combines with Renovation Cost and Flip Return for complete financial modeling.

For brokers, this means advising clients with confidence. For investors, it means avoiding properties that look good online but cost a fortune to fix.

5. Flip Return Metric: Projecting Net Profit on Fix-and-Flips

5. Flip Return Metric: Projecting Net Profit on Fix-and-Flips

The ultimate question in house flipping: Will this deal actually make money? Most investors use spreadsheets with manual inputs. But human error, optimistic assumptions, and missing costs lead to inaccurate projections.

The Flip Return metric automates the entire calculation:

Net Profit = After Repair Value (ARV) – Purchase Price – Rehab Costs – Holding Costs – Misc Costs – Selling Costs

AI enhances each variable:

- ARV: Based on hyperlocal comps with similar upgrades.

- Rehab Costs: Estimated via Renovation Cost API.

- Holding Time: Predicted using market absorption rates.

The result? AI-powered profit forecast with confidence intervals.

Who Benefits Most?

- Flippers: Validate deals before writing offers.

- Lenders: Assess risk on rehab loans.

- Brokerages: Offer clients data-backed flip strategies.

Key Takeaways

- Price Flexibility Score (PFS) reveals negotiation power before price drops.

- Investment Potential Metric identifies properties with the highest long-term returns.

- Renovation Return Metric predicts ROI on upgrades with 80%+ accuracy.

- Property Condition Metric flags hidden risks using AI analysis of photos and text.

- Flip Return Metric delivers automated, data-backed profit projections.

While companies like Zillow offer basic property data, they lack the predictive depth and financial modeling of Homesage.ai. Homesage.ai metrics are explicitly built for actionable investment decisions, not just data display.

Conclusion

In 2025, finding good deals isn’t about working harder—it’s about working smarter. The real estate investors who win are the ones using AI-powered metrics to see what others can’t.

These five tools:

- Price Flexibility Score

- Investment Potential

- Renovation Return

- Property Condition

- Flip Return

form a complete decision engine for identifying, evaluating, and closing profitable deals.

Homesage.ai powers this approach, giving real estate professionals a scalable, data-driven edge. Whether you’re an agent, investor, or developer, integrating these APIs means faster decisions, lower risk, and higher returns.

Frequently Asked Questions (FAQs)

Q: How is Homesage.ai different from Zillow or ATTOM?

A: While Zillow and ATTOM provide raw property data, Homesage.ai uses AI to generate predictive investment insights like Price Flexibility Score, Renovation ROI, and Flip ROI. Our APIs are designed for actionable decision-making, not just data lookup.

Q: Can I use these APIs on off-market deals?

A: Yes. Homesage.ai analyzes both MLS and off-market listings daily, giving you early access to hidden opportunities before they hit public platforms.

Q: Do I need a developer to use Investment metric APIs?

A: Not necessarily. Many partners integrate via no-code tools or use our pre-built dashboards. Developer documentation is available for custom builds.

Q: How much time can I save using Homesage.ai’s AI metrics versus manual property analysis?

A: Manual analysis takes 1-5 days per property. Homesage.ai analyzes properties in minutes. For investors screening 50+ properties weekly, that’s 40+ hours saved per week, letting you evaluate more deals faster.

5. Flip Return Metric: Projecting Net Profit on Fix-and-Flips

5. Flip Return Metric: Projecting Net Profit on Fix-and-Flips

2 Comments

Mike October 27, 2025

AI is the future of Real Estate investing!

James October 27, 2025

Nice info